Content of the phenomenon

The basis of inheritance is the legal and factual rights and obligations of all parties involved in the matter.

If the testator is alive, the heirs have no rights. They cannot make any demands at this time. Only after the opening of an inheritance can we speak of the emergence of hereditary relations. The testator always has the right to use the powers of the will or leave everything as is. After the death of the testator, certain persons are transformed into heirs who are required to make the following decisions:

- accept inheritance;

- refuse him.

Video about what it means to “accept an inheritance”:

In turn, officials (notaries) have an obligation to help a person accept an inheritance or refuse it.

Important! After going through the procedure of accepting an inheritance in a legal sense, the heir becomes the owner. This means that in addition to property rights, the heir will also bear all associated debts/responsibilities.

Who can be the heir

Legal heirs can be individuals who are alive on the day the inheritance is opened, or who were conceived during the life of the testator and born after the opening of the inheritance. Also, the state may be called upon to inherit an inheritance if the inheritance is recognized as escheatable property.

In addition to individuals, legal entities, municipalities, states, including foreign and international organizations can also be involved in inheritance under a will.

Who is a testator according to law?

Such strict restrictions are due to the fact that drawing up a will involves the execution of a person’s last will. This is a voluntary procedure. A person must come to its registration himself, without pressure from third parties.

If it is discovered that a person drew up a document while incapacitated (mental disorders, alcohol or drug intoxication) or did so under threats, then the will is revoked.

If a person becomes incapacitated after the document is drawn up, it does not lose its validity.

Who can be the testator

Firstly, because in this case there is no guarantee that he will have the rights to the apartment after the death of the testator, because the will can be canceled and drawn up in favor of another person. Thus, the last will of the testator cancels the previous one, if there was one.

Heirs and testators, who are they?

Sooner or later, a person dies, and all his property goes to his heirs - the other half, children, grandchildren, who are the closest relatives. The concept of inheritance includes all real estate - houses, apartments, land plots, garages and cars, money and jewelry, as well as other things that belonged to the deceased person.

Who can be the testator? The concept of an heir in inheritance law

Russian legislation is extensive. And many citizens do not know its key points, which can be useful at any time. Today we will talk about inheritance and its transfer. Who can the testator be? How is property transferred in the mentioned case? How can recipients of property register it?

We recommend reading: What does a deed of gift for a house mean?

Who is a testator: who can be one and how does he appoint heirs

In some cases, the concept of unworthy heirs arises. Legally, they may even be in the first place, but if in court it is possible to prove the unlawful actions of these persons in relation to the deceased, then by a court decision such persons may not participate in the process of transfer and division of property.

Who is the testator according to the law?

A person has the right to bequeath to his heirs any item of property, even one that he acquires sometime in the future.

He can draw up one or several wills, make a closed will when no one, including a notary, knows about its essence.

The testator has the right to cancel or amend some clauses or the entire text of the previous will at any time.

An heir is a legal successor of the testator

What does the law say on this issue? An heir is a party to inheritance legal relations who accepts the property of a deceased person, as well as the duties and rights associated with inherited objects.

In this case, property can imply tangible and intangible property. The deceased in such legal relations acts as a testator, i.e., the owner of the property being inherited during his lifetime.

Heirs and testators

Citizens are recognized as heirs if they are alive on the day of the testator's death. The Civil Code of the Russian Federation contains norms that are aimed at protecting the interests of already conceived but not yet born heirs, the interests of minor children, incapacitated citizens, as well as citizens whose legal capacity is limited.

If one of the heirs is an unborn child of the testator, the division of the inheritance is made only after the birth of this child. If the child is born alive, the inheritance is divided taking into account his interests, otherwise the division is void.

The legal representatives of the child (parents, adoptive parents, guardians) and the guardianship authorities must be notified about the upcoming division of the inheritance.

The concept of an heir in inheritance law

The norms of the Civil Code of the Russian Federation do not contain a definition of the testator, as well as heirs. Only in the legal literature have theorists developed the concepts of “heir” and “testator”. Some of them believe that the testator is the subject of inheritance legal relations.

However, this judgment is incorrect. The testator cannot be the subject of inheritance legal relations because he is no longer alive at the time the heirs are called to inherit.

Despite the fact that the testator is not the subject of inheritance legal relations, he does not occupy the last place in inheritance law.

Inheritance legal relationship: concept, elements

Inheritance legal relations

are social relations that arise during the transfer of material and intangible benefits of a deceased person to other persons in the order of inheritance, regardless of the basis of inheritance.

The composition of inheritance legal relations is formed by the following elements: subjects, content and subject of inheritance legal relations.

The subjects of inheritance legal relations are the heirs called to inherit. The testator is not the subject of inheritance legal relations, since he is no longer alive. With the death of the testator, his legal capacity ceases, and at the same time his participation as a subject ceases.

Heirs also include persons who were not born at the time of opening of the inheritance, but were conceived during the life of the testator. Heirs are called upon to inherit regardless of whether they are legally capable, an adult, a stateless person, a foreign person, etc. at the time of accepting the inheritance.

Legal entities can be heirs only by will. In this case, the legal entity must exist at the time of opening of the inheritance. To call a legal entity to inherit, it does not matter whether it is a commercial or non-profit organization. However, if a will is made in favor of a sect that is not a legal entity on the territory of the Russian Federation, then it may be declared invalid on the basis of a contradiction with public law and order. Other international organizations (UN) and foreign states may also be involved in inheritance. As for the testator, the making of a will by an incompetent person, a minor, etc. is the basis for declaring the will invalid. In this case, inheritance occurs according to law.

The content of inheritance legal relations is understood as the totality of the rights and obligations of its participants. The heir’s right to accept the inheritance comes first, and the corresponding duty of third parties should be considered not to cause obstacles in the heir’s exercise of his right. When accepting an inheritance, the heir becomes a participant in a wide variety of legal relationships. When accepting an inheritance, the heir may be burdened with an obligation that passes along with the inherited property (payment of debt in a loan obligation). However, the heir has the right to refuse to enter into these legal relations by renouncing the inheritance.

Inheritance legal relations arise regarding an object, i.e. inheritance.

Inheritance is a set of tangible and intangible rights transferred by inheritance from a deceased person to other persons on the basis of a will or law.

The process of development of inheritance legal relations is accompanied by 2 stages

:

— Stage 1 – the heir called to inherit has the right to accept the inheritance; exercise of this right;

— Stage 2 – the heir’s right to accept the inheritance is transformed into the right to the inheritance itself.

Let us trace what happens at each stage of development of the inheritance legal relationship.

At the first stage

:

- due to the opening of an inheritance, an inheritance legal relationship arises, i.e. this legal relationship arises from the moment of death of the testator;

- the opening of an inheritance is associated with the moment when heirs are called to inherit, who automatically have the right to accept the inheritance, which represents two opposing subjective rights - the right to accept the inheritance and the right to refuse the inheritance;

- the heir exercises his right to inheritance. In this situation, for the heir who has expressed his will to accept the inheritance, the inheritance relationship continues, and in relation to the heir who refused the inheritance, the inheritance relationship ends (in this case, the right to accept the inheritance arises from other persons - the heirs who will accept the inheritance instead of the one who has fallen away heir). With the implementation by the heirs of their right to accept the inheritance, the first stage of development of the inheritance legal relationship ends.

Second stage

is determined from the moment the heirs accept the inheritance and lasts until the fate of the inherited property is completely determined. At this stage the following is done:

- division of property between all heirs;

— registration by heirs of their inheritance rights to the testator’s property;

- protection of inherited property.

Thus, at this stage of development of the inheritance legal relationship, the heir’s right to accept the inheritance gives rise to the heir’s right to the inheritance itself.

The right to inheritance, in turn, is divided into a number of rights, depending on what is included in the inheritance. This could be: ownership of a particular thing; law of obligations (if the testator was a creditor or debtor in an obligation); personal non-property right (for example, the right to publish a work whose author was a deceased person and which was not published during the author’s lifetime); and others.

After the fate of the inherited property is completely determined (i.e. all heirs accept the inheritance, divide it among themselves, formalize their rights, etc.), the inheritance legal relationship ends. It is transformed into a civil legal relationship, associated with the right of ownership of property transferred from the testator to the heir, or with the law of obligations.

Private or singular succession is distinguished from universal hereditary succession. The singular successor does not acquire the entire set of rights and obligations belonging to the deceased, but only a separate right and acquires it not directly from the testator, but through the heir.

The testator may oblige the heir to perform one or another action in favor of one or more persons - provide premises in a house being inherited for lifelong use, transfer some thing or several things from the inheritance, give out a certain amount of money, etc. Such succession in individual rights of the deceased is not inheritance. In order for a person to terminate all legal relations that connected him with other persons up to this point, and for the emergence of the right to actually carry out the transfer of property and some personal non-property rights from this person to another, the occurrence of one of the legal facts with which the law associates such consequences must occur.

Subjects of hereditary succession

Testator

The subjects of hereditary succession are the testator and heirs.

Testator – a person after whose death inheritance succession occurs. It is often noted in the literature that the testator does not become the subject of hereditary succession, since the legal relationship itself arises only after the death of the citizen. It is difficult to argue against this statement. At the same time, data related to the figure of the testator is important for determining the conditions for the emergence of inheritance legal relations.

The testators can be Russian and foreign citizens, as well as stateless persons living in the territory of our country. Legal entities cannot leave inheritance: upon their termination through reorganization, the property passes to other persons in the manner prescribed by law (Article 58 of the Civil Code), and upon their liquidation, universal succession does not arise (clause 1, Article 61 of the Civil Code).

In order to consider a specific person as a testator, it is necessary to confirm his death or in the cases specified in Art. 45 of the Civil Code, the entry into force of a court decision declaring him dead.

Heirs

Heirs are persons specified by law or will as legal successors of the testator.

Any subject of civil law can inherit: a citizen, legal entity, state or municipality. Citizens and the state can be heirs both by law and by will. Moreover, a citizen’s ability to inherit in no way depends on the scope of his legal capacity. Legal entities can act as heirs only if a will is drawn up in their favor.

The circle of persons who can be called upon to inherit is determined by law (Civil Code). First of all, these are citizens who are alive on the day of opening of the inheritance, as well as those conceived during the life of the testator and born alive after the opening of the inheritance (paragraph 1 of Article 1116 of the Civil Code). According to the tradition established in Roman law, they are sometimes called “nasciturus” (from the Latin nasciturus - “fetus in the mother’s womb”), or “postumi” (from the Latin postumi - late, additional).

The Civil Code defines very broadly the circle of those who can be called upon to inherit under a will. In particular, in addition to the named individuals, these are also legal entities existing on the day of opening of the inheritance. In addition, the Russian Federation, constituent entities of the Russian Federation, municipalities, foreign states and international organizations may be called upon to inherit by will. Escheated property is inherited by law by the Russian Federation, and residential premises are inherited by municipalities or the cities of Moscow and St. Petersburg as subjects of the Russian Federation (clause 2 of Article 1151 of the Civil Code as amended by Federal Law No. 281-FZ of November 29, 2007).

Unworthy heirs

In an effort to best protect participants in inheritance relations, the legislator included in the Civil Code norms that prevent unworthy persons from inheriting.

Firstly, citizens who, by their deliberate unlawful actions directed against the testator, any of his heirs or against the implementation of the last will of the testator, expressed in the will, contributed or tried to promote the vocation of themselves or other persons to inherit or increase the share of the inheritance due to them or other persons. These circumstances must be confirmed in court (paragraph 1, paragraph 1, article 1117 of the Civil Code). At the same time, it should be borne in mind that citizens to whom the testator, after they lost the right to inherit, bequeathed property (i.e., essentially forgave them), have the right to inherit it.

Secondly, parents do not inherit by law after children in respect of whom they were deprived of parental rights and were not restored to them by the day the inheritance was opened (paragraph 2, paragraph 1, article 1117 of the Civil Code).

And finally, thirdly, at the request of an interested person, the court excludes from inheritance according to the law citizens who maliciously evaded the fulfillment of their obligations by law to support the testator (clause 2 of Article 1117 of the Civil Code).

If such an unworthy heir somehow nevertheless received certain property from the inheritance, he must return it as unjustly received in accordance with the rules of Chapter. 60 GK.

show content

Grounds for the emergence of inheritance legal relations

Testamentary relations arise from the moment the inheritance is opened, all participants in the process have equal powers, they are not subordinate to each other. The subjects are the heirs called to inherit.

A feature of testamentary relations is the obligatory condition in the form of the death of one of the parties, because these connections arise to implement the last will of the deceased subject. The free expression of the parties in the inheritance industry regulates the entire interconnection of relations, including property, non-property parties, and responsibilities.

Despite the death of one of the participants, his presence is indirect, distant in time. His will takes part in the matter, determined by him during his lifetime, only delayed in its occurrence within a time frame.

Important! Each person has the right to dispose of his property according to his own will, leaving recommendations for authorized citizens in the event of his own death.

Legal relations develop on the following grounds:

- subject's death;

- obtaining legal force by a court decision declaring a person dead;

- property of a deceased citizen, secured by legal acts;

- the presence of a will, duly executed (with the condition of family ties between the successor and the testator);

- whether the subject of inheritance is alive at the time he receives testamentary rights (the legal entity must confirm the fact of its own existence);

- mandatory contact with a notary according to the deadlines established by law.

Important! The presence of property of any kind in a deceased person is a mandatory condition for his participation in the inheritance matter.

Forms of deprivation of inheritance

The forms of depriving an heir of the rights to dispose of the inherited mass are as follows:

- Deprivation of the right to inherit by direct reference to those persons who, after death, will not be able to receive an inheritance.

- Deprivation of inheritance by delineating a strictly defined circle of persons as heirs, that is, keeping silent about any of the applicants.

However, along with the opportunities provided to deprive heirs of the legal status, the legislator established the impossibility of depriving close disabled relatives of property. In addition, Art. 1149 of the Civil Code names a list of relatives who claim a legal share of the inheritance.

Distribution of inherited assets among priority successors

It is legally established that the remaining savings are divided among all representatives of the 1st stage in equal shares. But depending on the type of followers and the type of ownership, other decisions can be made:

- When the testator's spouse is among the applicants, his share in the joint matrimonial property is first allocated, since it is not divided, but remains in his possession. The other part belonging to the deceased is subject to division by the remaining relatives, which includes the surviving spouse;

- The share of a descendant who has the powers of a representative is divided among his successors in equal parts. Depending on the number of descendants, the size of the share will be determined. For example, when there are two of them each receive half, three - 1/3, etc.;

Regardless of the rules for determining the size of shares established by law, successors have the right to themselves determine the sequence of distribution of inherited property and their size by concluding a joint agreement.

If agreement cannot be reached, division may be carried out in court.

- Indivisible property, representing things that cannot be divided without causing harm to their integrity. If such an object is transferred into personal possession, then only one applicant can purchase it. Such an action entails the collection of material compensation in favor of other participants in the procedure;

- Personal property of the deceased. Values are distributed among successors in the form of shared, joint and other ownership.

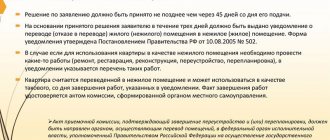

Methods and timing of accepting an inheritance

Acceptance of inheritance is possible in two ways:

1) filing an application for the issuance of a certificate of the right to inheritance or for acceptance of an inheritance to a notary or an official authorized to perform notarial acts (for example, the head of local government in the Far North), at the place of opening of the inheritance;

2) by performing conclusive actions, i.e. actions aimed at actually entering into inheritance rights.

These methods of accepting an inheritance are the basis for the emergence of rights to property. To obtain a certificate of inheritance or the right to accept an inheritance, the heir must contact a notary or other official authorized to carry out notarial acts. The application can be submitted personally by the heir, by post, or with the help of a representative. If the heir is unable to personally bring the application, then the application must be signed by the heir, and this signature must be certified by a notary. When submitting an application by the heir in person, signatures and notarization are not required. If the heirs apply to the court to obtain the right to accept the inheritance or a certificate of the right of inheritance, the actions of the person are not grounds for refusal to transfer the inheritance and the deadline is not considered missed.

Acceptance of an inheritance is possible through a representative.

The powers of the representative must be certified by a power of attorney executed in accordance with the requirements imposed by law.

The power of attorney must provide for the right to accept inheritance on behalf of the heir. A power of attorney is not required to accept an inheritance by a legal representative. Acceptance of an inheritance by one heir is not the basis for acceptance of the inheritance by other heirs. Minors aged 14 to 16 years

have the right to accept an inheritance with the consent of their parents. Incapacitated persons accept inheritance with the permission of their trustees.

Another way of accepting an inheritance can be expressed in the fact that the heir actually uses the inherited property, thereby confirming that he has accepted the inheritance and treats it as property. For example, during the period of acceptance of the inheritance, the heir continues to pay utility bills for the apartment and other things. By this, the heir confirms the fact of acceptance of the entire inheritance due.

The heir must complete all the above actions within the prescribed period of 6 months.

The period for accepting an inheritance can be extended outside of court proceedings if there is the consent of all heirs. The basis for restoring the period for accepting an inheritance cannot be: concealment by one of the heirs when accepting the inheritance of information about other heirs, the heir’s employment and lack of material means to arrive at the place of opening of the inheritance, etc. Upon entry into the rights of inheritance of such an heir, all previously received documents are canceled.

For any inheritance issues, you need specialist advice, use our service: Lawyer for inheritance cases in Moscow.

Related links:

Inheritance Law Test with Answers

1. The grandchildren and great-grandchildren of the testator shall inherit by law: • if at the time of opening of the inheritance one of their parents who would be the heir is not alive

2. Refusal of inheritance in favor of other persons from among the heirs under the will: • is allowed

3. The possibility of canceling a new will as a basis for restoring the validity of a previously drawn up will: • not provided for by law

4. The rules on the interruption of the statute of limitations for the time limits for filing claims by the testator’s creditors: • do not apply

5. Do parents legally inherit after children in respect of whom the parents were deprived of parental rights in court? • No

6. Persons convicted of committing careless murder of a testator are called upon to inherit: •

7. Children born from a marriage subsequently declared invalid: • inherit first

8. Heirs under a will can be: • any persons

9. Hereditary transmission is: • transfer of the right to accept an inheritance to the heirs of the deceased, who was called to inherit, died after the opening of the inheritance, without having time to accept it in the prescribed manner

10. Partial renunciation of inheritance: • not allowed

11. Maksimov A. died on April 25, 1999 at 11 p.m., his wife Maksimova N. died on April 26, 1999 at 1 hour 32 minutes. Maksimov had a daughter from a previous marriage, Maksimov had a son. If we take into account that the entire inheritance consists of property acquired during marriage, the share of Maximova’s son is: • 3/4

12. The place of residence of the testator is the place of: • his permanent or primary residence

13. Can citizens who were conceived during the life of the testator and born alive after the opening of the inheritance be called upon to inherit? • Yes

14. Waiver of the right to make a will is: • void

15. From the moment of opening of the inheritance, acceptance of the inheritance must be carried out within: • 6 months

16. What order of heirs are the grandfather and grandmother of the deceased: • second

17. Determination by the testator of the subsequent fate of the bequeathed property: • is not allowed

18. N. died and his son O. was called to inherit, but he died before he could accept the inheritance. N.’s property passes to: • O’s heirs.

19. The right to receive a copyright certificate for an invention in the inheritance estate: • includes

20. Missing the deadline for the testator’s creditors to present their claims against the testator: • extinguishes the right of claim

21. The rules on restoring the statute of limitations for the time limits for filing claims by the testator’s creditors: • do not apply

22. The obligation to execute a testamentary refusal for the heir: • occurs if he accepts the inheritance

23. Children of the deceased are heirs in line: • first

24. A. bequeathed a house that belonged to her as personal property to S., imposing on him the obligation to provide B. with lifelong use of the house. This action of the testator is called: • testamentary refusal

25. When inheriting by law, heirs of the first priority inherit: • in equal shares

26. Wills of citizens who are sailing on ships flying the flag of the Russian Federation, certified by the captains of these ships: • are equal to notarized ones

27. If there are grounds to believe that the certificate of inheritance was issued illegally, it may be: • declared invalid in court

28. The heir who accepted the inheritance is liable for the debts of the testator: • within the limits of the actual value of the property transferred to him

29. Indication in the will of the time and place of its preparation: • mandatory

30. According to current legislation, the testator can be: • only an individual

31. The right of a testator to entrust to the heir the execution of actions aimed at achieving any generally beneficial purpose: • is called entrustment

32. Escheatable property passes by inheritance by law into the ownership of... • the Russian Federation

33. Changing a renunciation of inheritance made within the established period: • is not allowed

34. In the absence of heirs by law and by will, the copyrights of the deceased: • are terminated

35. The heir by law can be: • individuals and the state

36. The basis of inheritance is the subject of an agreement: • cannot be

37. The Sidorov couple died within one day. From their marriage they had a common son, from previous marriages Sidorova had a daughter, Sidorov had a son. The entire inheritance consists of property acquired during the marriage. Sidorova’s daughter’s share of the spouses’ common property is: • 1/4

38. The testator can deprive the right of inheritance: •

39. L. went to court to N. to collect the debt of the testator O. after 1 year from the date of death. His claim will be: • not satisfied

40. Can intangible benefits be the subject of inheritance? • no, but they can be protected by relatives

41. Evidence of taking possession of an inheritance can be: • a certificate from the housing authority that the heir has taken the testator’s property

42. The place of opening of inheritance, if it is impossible to establish the permanent residence of the testator, is recognized as: • location of the property

43. The right to receive alimony is included in the estate: • not included

44. The time of opening of the inheritance is considered: • the day of death of the testator

45. The heirs of the first priority according to the law are: • children, spouse and parents of the testator

46. Is acceptance of an inheritance subject to conditions allowed? • not allowed

47. A foreign citizen is an heir under a will: • may be

48. The priority form of inheritance under current legislation is... • inheritance by will

49. Illegal actions of a person directed against the testator, which contributed to calling him to inherit, are grounds for deprivation of the right to inherit: • are if these actions are intentional in nature

50. Is a “closed will” allowed under current legislation, when the testator does not provide the notary and other persons with the opportunity to familiarize themselves with its contents? • Yes

51. Claims of the testator’s creditors, the deadline for fulfillment of obligations for which by the time the inheritance was opened: • are presented within 6 months from the date of opening of the inheritance

52. If, in the absence of heirs by law, only part of the property is bequeathed, the rest of the property is inherited by: • the state

53. Of the listed requirements for registration of a transaction, the following apply to a will: • personal signature • written form • certificate

54. The heir by law has the right, from the date of opening of the inheritance, to refuse the inheritance within the following period: • 6 months

55. If the heir filed an application to accept the inheritance, but died before receiving the inheritance, a certificate of the right to inheritance is issued within a period calculated from the date of: • the death of the second heir

56. Creditors of the testator have the right to present their claims within the following period: • 6 months

57. Refusal of inheritance is allowed in favor of: • any number of heirs

58. Refusal of inheritance is carried out by submitting an application to the notary office at the place: • opening of the inheritance

59. As a general rule, the following legislative form is established for a will: • written form, certified by a notary

60. How many lines of inheritance according to law are provided for by current legislation? • seven

61. Citizens who, by their illegal actions directed against the testator, contributed to their calling to inherit: • are deprived of inheritance by law

62. If the testator bequeathed all his property to the appointed heirs, then the share of the inheritance due to the fallen heir: • is distributed among the remaining heirs according to the will

• does not have the right to accept an inheritance

64. If the death of citizens who, by law or by will, could inherit one after another, occurs within one day, after them the following will inherit: • heirs along the line of each

65. Of the listed methods of making transactions, a will can be executed by the following(s): • by power of attorney

66. Heirs of the second stage are called upon to inherit by law: • in the absence of heirs of the first stage or if they do not accept the inheritance, as well as if the heirs of the first stage are deprived by the testator of the right to inherit

67. N., who was the author of the book, died on January 6, 95. The property left after N. consists of his own house, home furnishings and car. N. has no heirs by law and did not leave a will. In this case, the following goes to the state: • house, home furnishings and car

68. The obligatory share is calculated based on: • the entire inheritance mass

69. Is an oral will allowed? • No

70. The obligation of the testator to transfer certain property to the heir to third parties: • is allowed

71. Do parents inherit by law after children in respect of whom the parents were deprived of parental rights in court, but were restored to these rights at the time of opening of the inheritance? • inherit

72. The right to receive a pension is included in the estate: • not included

73. If the heir refuses the inheritance without indicating in whose favor he refuses, his share passes: • equally to those heirs who accepted the inheritance

74. The time of opening of the inheritance is confirmed by: • death certificate

75. When distributing an untested part of property, the number of heirs includes: • all heirs by law, including those to whom another part of the property was bequeathed

76. Disabled persons who were dependent on the deceased for at least one year before his death inherit: • always and on an equal basis with other heirs

77. Refusal of inheritance in favor of other persons from among the heirs by law: • is allowed

78. The period for filing claims by the testator’s creditors begins to run from the day: • opening of the inheritance

79. A certificate of the right to inheritance is a document: • confirming the right

80. The blood parents of an adopted person after his death: • do not inherit

81. Is it permissible to make a will through a representative? • not allowed

82. Is acceptance of inheritance with reservations allowed? • No

83. Extension of the established period for accepting an inheritance: • can be done by the court

84. According to current legislation, an heir can be: • any subject of civil law

85. Acceptance of an inheritance is carried out by submitting an application to the notary’s office at the place of: • opening of the inheritance

86. The basis for opening an inheritance is: • the fact of the death of a citizen

87. Verification of the testator’s legal capacity is the responsibility of: • the person certifying the will

88. The estate includes property: • legally owned by the testator

89. The place of opening of inheritance is recognized as: • permanent place of residence of the testator

90. The surviving spouse is the heir in line: • first

91. A will executed with the help of an executor is considered made: • personally

92. The creditor of the testator may demand the fulfillment of the obligations of the testator on time: • fulfillment of the relevant obligation

93. Adopted children of the deceased are heirs in line: • first

94. Adult children who have maliciously evaded the responsibilities incumbent upon them by law to support their elderly parents: • cannot inherit if this circumstance is confirmed in court.

95. When opening an inheritance in connection with the court declaring the testator deceased, the date of opening of the inheritance is considered the date of: • the entry into force of the court decision declaring the missing person deceased

96. Brothers and sisters of the deceased are heirs in line: • second

97. Proof in court of the fact of an oral statement of a will: • is not allowed

98. To acquire an inheritance, the following is required: • the will of the heir

99. The rules on suspending the statute of limitations for periods for filing claims by creditors of the testator: • do not apply

100. As a general rule, an inheritance can be accepted within... • six months from the date of opening of the inheritance

101. Great-grandparents of the testator belong... • to the fourth stage

102. Is it permissible for two or more citizens to make a will in the form of one document? • not allowed

103. The part of the property that remains intestate: • is divided among the heirs according to the law.

104. In the event of a stillbirth of a child conceived during the life of the testator, his share: • is distributed accordingly between the heirs by law and by will

105. A child of the deceased, born after his death, as a general rule: • does not inherit

106. A will is a transaction: • unilateral

107. Of the listed methods of performing actions, a certificate of the right to inheritance can be obtained: • in person • by power of attorney • through a legal representative

108. An accepted inheritance is recognized as belonging to the heir from the moment of: • opening of the inheritance

109. The testator’s order to disclaim a will must be made: • in the text of the will itself

110. In case of hereditary transmission, a certificate of the right to inheritance is issued within a period calculated from the date of: • death of the first heir

111. Half-brothers and sisters after each other: • do not inherit

112. If the testator draws up a new will, and he has already made a will: • the old one loses its legal force

113. Personal non-property rights are included in the inheritance mass: • included in the cases specified in the law

114. An heir who renounces the inheritance is not liable for the debts of the testator: •

115. A certificate of the state’s right to inheritance is issued: • after 6 months from the date of opening of the inheritance

116. Cousins after each other: • do not inherit

117. Is the testator, when depriving one, several or all heirs of the inheritance by law, obliged to indicate the reasons for such deprivation? • No

118. The clause on the irrevocability of a will is: • void

119. A. bequeathed his house to M., and all other property to O. On the day the inheritance was opened, M. was not alive. The house goes to: • Oh.

120. Wills of persons in places of deprivation of liberty, certified by the heads of places of deprivation of liberty: • are equal to those notarized

121. The period for issuing a certificate of inheritance is issued after: • 6 months

122. The imposition by the testator on the heir of property obligations is called: • testamentary refusal

123. Presentation of evidence confirming the testator’s right to the bequeathed property when certifying a will: • not required

124. In the event of actual non-residence between spouses whose marriage has not been dissolved, the surviving spouse: • inherits first of all

125. Grandchildren and great-grandchildren inherit: • by right of representation

126. The state to which the inherited property was transferred is liable for the debts of the testator: • is liable within the limits of the actual value of the property transferred to it

127. An heir who died an hour after the death of the testator, but on the next calendar day: • has the right to inheritance

128. Refusal of an inheritance by an heir who has applied to a notary’s office with an application to accept the inheritance: • is not allowed

129. Refusal of inheritance in favor of a cooperative organization: • permitted

130. Can a citizen bequeath property that he may acquire in the future? • Yes

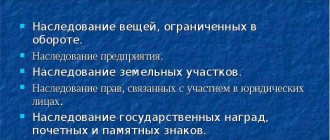

Types of inheritance

The inheritance can be various material and intangible benefits that were acquired by the testator: real estate, transport, financial assets, some types of rights. Inheritance is the transfer of all property of the deceased to his heirs on the basis of the law or the left will of the citizen (will). What types of inheritance exist in the Russian Federation?

In law

Special right of inheritance for spouses: the husband or wife can claim half of the entire inheritance if the property left was jointly acquired, and also a share in the remaining half as a first-priority claimant.

In the absence of the main recipients of the testator's possessions, the right of inheritance passes to the next circle of relatives. The order in 2021 according to the law is as follows:

- Parents, spouses, children.

- Siblings, grandparents.

- Dear uncles and aunts.

- Great-grandparents.

- Cousins and aunts, grandchildren.

- Cousins and great-grandchildren.

- Step relatives: stepmother, stepfather, stepdaughter and stepson.

In the absence of all types of heirs, the property left by the testator is transferred to the benefit of the state. Acceptance of an inheritance is required by law within six months from the date of death of the owner. Otherwise, the inheritance right will pass to another order of recipients.

The basis for considering a citizen as a successor will be documents proving a family relationship with the deceased. These may be marriage or birth certificates, guardianship or adoption orders.

By will

A will is a document that is drawn up in a notary's office and expresses the will of the applicant regarding his rights and possessions. In this case, both a relative and a person who has no family ties with the testator can become an heir.

The document indicates both one and several applicants for receiving the inheritance. The testator may or may not indicate the size of the share of each recipient. In this case, the notary will divide the property equally between all persons indicated in the document.

The possibilities of a will are not limited only to the choice of heirs. The testator has the right to indicate unworthy successors who will not be able to enter, even if they have the right to do so by law.

The basis for registering inheritance in this situation will be a testamentary document. Receivers need to find the paper and provide it to the notary's office to confirm their rights to the property.

Under contract

Relatively recently, a new type of inheritance has appeared - by contract. During his lifetime, the testator enters into an agreement with another person or organization to provide services in exchange for the right to inherit acquired property.

An example of this type would be an agreement for the care of an elderly person by a legal or natural person in exchange for the right of inheritance.

The parties' agreement on mutual benefit is registered at a notary's office. In this case, the recipient of the testator’s property will be the responsible party if the terms of the agreement are fulfilled in good faith. The rights of other applicants by law and by will in the presence of such a document are not recognized.

It is impossible to terminate the agreement unilaterally. The consent of both parties is required. A contract can only be terminated individually in court if there are compelling arguments: failure to fulfill obligations by the responsible person due to his dishonesty or due to certain situations, for example, illness.

Right to mandatory share

When inheriting by law and by will, there is a category of successors who have the right to an obligatory share. These include:

- Dependents of the testator who lived on his territory and had financial dependence for a period of at least a year.

- Incapacitated or disabled spouses, parents and children of the deceased.

- Minor children, including from a previous marriage.

The size of the mandatory share is 50% of the part that could go to the recipient as part of inheritance by law. The allocation of property occurs from the total mass of the deceased’s possessions, and also by reducing the shares of other existing claimants.

Structure of inheritance legal relations

The structure of inheritance legal relations consists of objects, as well as subjects with powers and responsibilities.

The testator has the right to draw up a will, a unilateral transaction, where he acts as an authorized person who has subjective rights (to dispose of objects belonging to him at his own discretion, in the event of death). This power has three components:

- The ability of the subject to perform actions that are actually and legally significant: to bequeath any type of property belonging to him, on any terms, to a selected citizen. Moreover, a right of this type will arise only after the death of the testator.

- The requirement to make certain decisions and maintain proper behavior from interested parties receiving inheritance rights. Protection from inaction or illegal actions of third parties who do not have the authority to interfere with the legal heir in carrying out the will of the deceased (for example, a notary who does not want to certify the desire of the deceased).

- The right to protect one's own rights.

We recommend reading: Trust management of inherited property

The heir also has rights secured by law:

- acceptance of heritage or refusal of this action, independent choice of ways to dispose of the received values;

- requirement of behavior from other citizens: third parties, government bodies must facilitate the preparation of documents for obtaining property, without creating artificial obstacles to this expression of will;

- the opportunity to protect one’s own rights established by law.

The concept of civil procedural legal relations presupposes the acceptance of bequeathed property by a person, and debts and credit obligations also pass to the new person, forcing him to take measures to ensure them.

From the deceased person, other subjects of legal relations are also given a number of rights and obligations. These include:

- a person who has received by the testator the authority to execute his will (bringing the will into legal force);

- debtors, creditors;

- legatees;

- notary officer;

- officials of government bodies.

Content

The content of the inheritance legal relationship is determined by the presence of the object of inheritance, the subject bequeathing his own property and the person receiving the rights to such property, as well as the relations arising in this regard.

An object is a mass of property belonging to one person, distributed after his death among a person or a circle of subjects.

Relationships are the right of choice of the heir, which consists in the ability to accept the values received or refuse to receive them. This includes other actions necessary for implementation in the event of inheritance: drawing up documentation, receiving it, fulfilling the duties assigned to the person by the testator.

The concept of subjects is more complicated: one of them disappears (due to his own death), the other is determined according to a will or by law. In fact, this group includes only heirs who have received the right of inheritance and actually accepted it. This includes citizens who do not receive property, but who perform special duties.

Participants in legal relations of the hereditary type are separately noted:

- notary offices and their representatives;

- public authorities with officials;

- translators;

- witnesses (certifying the process of writing wills);

- executors (who sign a will in place of a person who is unable to perform this function);

- executors of the will of the deceased.

We recommend reading: Sources of inheritance law: primary and secondary

Persons without personal interest take part in the inheritance process.

Subject and object of inheritance legal relations

Objects of inheritance legal relations contain things of a material nature that are the subject of inheritance. This is property belonging to the deceased testator, which passes by right of inheritance to a successor chosen or appointed by law.

Types of objects:

- movable and immovable property;

- values;

- stock;

- debt and credit obligations.

The subjects of inheritance legal relations include a number of persons:

- testator;

- successor;

- authorized bodies.

Heirs are not only individuals (heirs conceived during the life of the testator, of any gender, age, citizenship, other characteristics), but legal entities (societies, enterprises, organizations of all forms of ownership), the state at different levels of government (escheated type of inheritance).

Inheritance according to a will arises on the following grounds:

- death of the participant owning the property;

- notarized document;

- actions necessary to accept a will.

Important! According to legal grounds, inheritance is assumed by persons who are in different degrees of kinship in relation to the testator. The exact list is established by civil law.

In the absence of heirs, either legally or according to a will, the values are recognized as escheat, passing to the state, represented by the authorities.

Relationships of the inheritance type arise after the death of the testator, with the transfer of property to legal successors. Only individuals can participate here; the legal form does not have the right of inheritance.

The requirements apply to the testator (without possessing them, a person cannot become one):

- being in a capable state with a full understanding of what is happening around: this includes persons not under the influence of potent medications, narcotic substances, or alcoholic beverages;

- adulthood (citizen's age over 18 years, marital relations confirmed by law, individual entrepreneurship).

Important! Inheritance according to the law is distinguished by other features of the emergence of legal relations. Acceptance of inheritance is carried out by a legally capable person.

Making a will by an incapacitated citizen leads to its cancellation.

We recommend reading: Liability of heirs for the debts of the testator

The law clearly stipulates that property transferred by inheritance cannot be prohibited for circulation (narcotics, chemical substances). The weapon is transferred to a person who has a special permit for its use and storage. If these parameters are not met, all valuables are subject to sale, with subsequent transfer of funds to the heir.

Subject of legal relations

Inheritance legal relations arise from the moment of death of the person who is the testator. The subject of these powers is the property, values, property of the subject.

These may be property rights and intangible benefits.

A person is able to inherit:

- ownership;

- car or other equipment;

- real estate;

- jewelry;

- plots of land;

- funds (cash or on a bank deposit);

- debts and obligations of the testator (loans, mortgages, alimony debts).

If the successor is unwilling to pay the debts of the deceased relative, he constitutes a waiver of the property, with the repayment of all debts by selling the property of the testator.

Important! The emergence of testamentary legal relations is impossible without the presence of the subject, object, subject of these powers.

Some aspects of inheritance law: types of inheritance

Inheritance is the property, legal rights and certain obligations resulting from inheritance. The inheritance mass consists of material assets, copyright, property and other rights, the owner of which was the testator. The exception is the personal rights and obligations of the latter, the list of which includes:

- The right to compensation for damage caused to the well-being and life of a deceased citizen.

- Rights and obligations to pay alimony.

- Rights and obligations secured by unpaid use agreements, orders, commissions, agency agreements.

- Personal immaterial and intangible rights.

takes place on the day of the citizen’s death. In special situations, the date of opening of the inheritance is established by a court verdict. Persons who died at the same time (commorients) cannot be appointed as each other’s heirs, since they are considered to have died at the same time. When a situation of this type arises, the heirs of each commorient are involved in the inheritance.

the last permanent place of residence of the deceased, the location of property located outside the Russian Federation, or the location of the most valuable real estate included in the general composition of the hereditary mass are assigned.

The heirs are individuals alive at that moment and necessarily nasciturus, conceived before the death of the testator and born alive after the opening of the inheritance. All types of inheritance apply to them.

Citizens convicted of committing deliberate illegal acts against the testator, his relatives or against the execution of the will of the deceased, regardless of the goals, motivation and consequences, cannot claim the right to receive an inheritance in one form or another. For this purpose, a court decision is mandatory.

In addition, persons who do not fulfill their duties and obligations to support the testator and the necessary care for him lose their rights to inheritance. In no case do parents who are deprived of their rights to raise and support them, i.e., parental ones, become heirs of deceased children.

Inheritance rights are infringed upon by heirs and their direct descendants in the event of deprivation of inheritance, specifically stipulated by the testator in the will. For everyone listed in the will, a sub-appointment of heir applies, transferring the right of inheritance to other citizens. The testator himself comes to the conclusion who should accept the inheritance in the event of the death of the heir included in the will.

Hereditary mass

The estate is the property, non-property obligations and rights belonging to the testator. After the death of the testator, his rights of ownership cease, and the same relations arise (according to the rules established by law), but with his legal successor.

The hereditary mass consists of:

- property (things, valuables, real estate, transport, money);

- powers (objects of the material world with monetary value).

The second point includes the opportunity to take part in legally significant processes, receive royalties, the inventive sphere (patents for inventions), and commercial concession agreements.

There are a number of rights that are not included in this area:

- pension and social payments;

- the powers of the testator relating directly to his personality.

Sources of inheritance law

Sources

inheritance law are a hierarchical system of regulations containing the rules of inheritance law and regulating inheritance legal relations.

The primary source of inheritance law

is the Constitution of the Russian Federation. The right of inheritance is guaranteed by Art. 35 of the Constitution of the Russian Federation. From this article it follows that the state guarantees the transfer of property rights from the testator to the heirs, if not by will, then by the right of inheritance by force of law; the right to inherit any property belonging to the testator; The state establishes restrictions on the freedom of will by determining the obligatory share. However, the law may establish restrictions on the freedom of will of property owned by the testator (property limited in civil circulation, as well as property withdrawn from civil circulation).

Inheritance legal relations are also regulated by Federal laws adopted in accordance with the norms of the Constitution of the Russian Federation. This type of sources includes:

- norms of the Civil Code of the Russian Federation, part one dated November 30, 1994 No. 51-FZ, part two dated January 26, 1996 No. 14-FZ, part three dated November 26, 2001 No. 146-FZ and part four dated December 18, 2006 No. 230-FZ (Civil Code of the Russian Federation);

- norms of the Tax Code of the Russian Federation, part one dated July 31, 1998 No. 146-FZ and part two dated August 5, 2000 No. 117-FZ (Tax Code of the Russian Federation);

- norms of the Land Code of the Russian Federation of October 25, 2001 No. 136-FZ (Land Code of the Russian Federation);

- norms of the Fundamentals of Legislation of the Russian Federation on notaries dated February 11, 1993 No. 4462-I, which regulate the rules and procedure for making a will by a notary;

- norms of intellectual property laws (it is impossible to transfer the right of authorship to a work by inheritance, etc.);

- other regulations.

In practice, when inheritance legal relations arise, many controversial situations arise (incorrect interpretation of legal norms, conflicts of law, etc.). To correctly resolve issues related to the application of the rules of inheritance law, it is necessary to resort to clarifications of the Plenum of the Supreme Court, as well as the Constitutional Court. Not all authors adhere to the point of view that the rulings and rulings of the Supreme Court and the Constitutional Court are sources of inheritance law, since the courts do not have the right of legislative initiative, i.e. rulings and rulings are not normative in nature, but are only advisory and explanatory character. Despite the fact that many authors do not consider the explanations of the Supreme and Constitutional Courts to be sources of inheritance law, they are necessary material when resolving controversial situations when applying the rules of inheritance law.

1.2. Concept, subject and principles of inheritance lawInheritance law as a sub-branch of civil law is a set of legal norms governing social relations that arise during the transfer of property (property rights) of the deceased to the heirs in the order of universal succession. Inheritance law is considered in an objective and subjective sense. In an objective sense, inheritance law is a set of legal norms governing social relations, which form a sub-branch of civil law. The meaning of inheritance law in an objective sense is that every person is guaranteed the opportunity to live with the knowledge that all his property will pass after death to his loved ones. It follows from this that the subject of this branch of law is civil law relations arising in connection with the opening of an inheritance, protection, implementation and registration of inheritance rights. In a subjective sense, inheritance law is expressed in the ability of a specific subject of a civil legal relationship to inherit the property of the deceased. In the conditions of the emergence of market relations and the consolidation of the right of private ownership of property to citizens, the ability to dispose of it in the event of death at one’s own discretion becomes especially relevant. The guarantees of this right are enshrined in Part 4 of Art. 35 of the Constitution, which states that the right of inheritance is guaranteed. Since this provision is placed in the article on private property rights, this norm is not a direct rule and refers to industry legislation. The meaning of inheritance law in a subjective sense lies in the fact that the right of inheritance for a specific person arises only if there are grounds specified in the law: the presence of a relationship with the testator, his inclusion in the circle of heirs through the testator making a will. Thus, in contrast to the subject of civil law, the subject of inheritance law is narrower and is reduced only to those civil legal relations that arise in connection with the opening of an inheritance, the implementation and registration of inheritance rights, and their protection. Principles of inheritance law. The principles of inheritance law, as one of the relatively independent sub-branches of civil law, are understood as the fundamental principles on which all rules governing relations regarding inheritance are based. These principles may include the following. 1. The principle of universality of hereditary succession. This is the most important principle of inheritance law; it means that between the will of the testator, aimed at ensuring that the inheritance goes exactly to those to whom it will go, and the will of the heir who accepts the inheritance, there should be no intermediary links, except in cases expressly provided for by law (for example, if the heir is incapacitated , then his legal representative accepts the inheritance for him). The universality of hereditary succession means that the act of accepting an inheritance applies to the entire inheritance, no matter what it is expressed in and no matter who has it. The inheritance cannot be accepted partially, under conditions or with reservations. In other words, the heir accepts all the property and all the rights and obligations without any exception, without knowing what is included in the inheritance - the testator's bank deposits, his shares or his debt obligations. 2. The principle of freedom of will. It is a concrete expression of principles inherent in civil law, such as the principle of permissive orientation and the principle of discretionary civil law regulation. This principle means that the testator can dispose of his inheritance at his own discretion in the event of death, or may not dispose of it at all; can leave an inheritance to any subject of civil law; at your discretion, distribute the inheritance among the heirs; disinherit all or part of the heirs; draw up special testamentary dispositions. In accordance with this principle, the will of the testator, when drawing up a will, its subsequent cancellation or amendment, must be formed completely freely, no one should put pressure on him either directly or indirectly, taking advantage of the helpless state of the testator, blackmailing him, threatening to cause harm to himself or his loved ones etc. The principle of freedom of will can be limited only in one case, directly provided for by law: the testator cannot, either directly or indirectly, deprive the necessary heirs in the will, the circle of whom is provided for by the Civil Code, of the obligatory share due to them, which is reserved for them. At the same time, the law sometimes defines the circle of persons to whom this or that inherited property cannot be bequeathed. Thus, only citizens, as well as non-profit organizations, can be recipients of a permanent annuity, but the rights of a recipient of a permanent annuity cannot be transferred to a commercial organization, including through inheritance. 3. The principle of taking into account not only the actual, but also the intended will of the testator. The effect of this principle is expressed primarily in how the circle of heirs is determined by law, who are called upon to inherit in the event that the testator did not leave a will, or it is declared invalid, or part of the property is not bequeathed. In inheritance law, the circle of heirs by law is determined on the assumption that if the testator himself disposed of his inheritance, he would leave it to one of those who are classified as heirs by law. This largely explains the establishment of the order of calling heirs by law to inheritance. First, the heirs closest to the testator are called in - the surviving spouse, children, parents, and only in their absence, including because they refused the inheritance, are heirs of a more distant degree of kinship in the direct or collateral line called in. The same criterion is maintained in cases where heirs of subsequent orders are called to inherit by law. Of course, with this approach, it may happen that an heir with whom the testator did not communicate due to some kind of personal hostility will be called to inherit, but the legislator does not focus on exceptions to the general rule, but on typical situations, although this may involve costs. In addition, the testator can protect himself from calling unwanted heirs to inherit by drawing up a will. Taking into account the presumed will of the testator also takes place in cases of application of the rules on the increment of inherited shares. The testator may indicate in the will another heir in the event that the heir appointed by him dies before the opening of the inheritance or refuses it. But if the testator did not do this, the share of the fallen heir will pass to other heirs who are called to inherit by law or by will. This rule was again established on the assumption that this is how the testator himself would have disposed of the share of the fallen heir. 4. Principles of permissive orientation and dispositivity. These principles operate in inheritance law not only in relation to the testator, but also to the heirs, who, if called upon to inherit, are given freedom of choice: they can accept the inheritance, but they can also refuse it, and if the heirs neither directly nor indirectly express their desire to accept the inheritance, it is considered that they have refused it. The will of the heir should not depend on any influence of other persons, regardless of whether this influence is aimed at accepting or refusing to accept the inheritance. In case of pressure, the will of the heir may be declared invalid on the grounds for recognizing transactions as invalid. 5. The principle of protecting the foundations of law and order and morality, the interests of the testator, heirs, other individuals and legal entities in inheritance relations. This principle in inheritance relations is reflected in a large layer of rules of inheritance law, being, as it were, the outline of the industry. For example, it is enough to recall in this regard the exclusion of unworthy heirs from inheritance, which is carried out primarily in order to protect the foundations of law and order and morality. The protection of the testator's interests is ensured by maintaining the secrecy of the will (Article 1123 of the Civil Code), interpreting the contents of the will exactly as the testator intended at the time of drawing up the will, and fulfilling all legally binding orders of the testator regarding the inheritance. No less importance is attached to protecting the interests of the heir, including in relations where the heirs, in accordance with the universality of hereditary succession, act as obligated persons. Other individuals and legal entities whose interests are subject to protection include the testator's creditors, as well as legatees, trustees, etc. 6. The principle of protecting the inheritance itself from anyone's unlawful attacks. In inheritance law, this principle is enshrined in Art. 1171 of the Civil Code, it is also embodied in a system of norms ensuring the protection and management of inheritance, reimbursement of related expenses, division of property between heirs, etc. Measures for the protection of inheritance are: 1) inventory of inherited property; 2) assessment of inherited property; 3) depositing cash included in the inheritance with the notary; 4) transfer to the bank under a storage agreement of currency valuables, precious metals, stones and products made from them; 5) trust management of property. The presence of all the listed principles, characteristic only for this section of civil law, gives sufficient grounds to believe that there is a relatively independent division of the branch of law - a sub-branch, which in the future can develop into an independent branch.

The principle of allocating shares

The entire inheritance mass is divided equally among the heirs of the first stage.

When members of his family lived together with the testator, their shares of property are first allocated, that is, the inheritance mass is determined - the property belonging to the testator.

For example, if there are five first-degree heirs, each of them will receive exactly one-fifth of the inherited property.

When inheritance is by right of representation, shares are determined differently. The share that should have belonged to the deceased heir is distributed equally among his heirs. Shares of the inheritance can be distributed in accordance with the agreement reached by the heirs themselves.

Warning

A formally drawn up agreement confirms the rights to the inherited property. If problems arise in dividing the inheritance, establishing the right of inheritance, or there are property disputes, they go to court.

Registration of inheritance: who has the right to join

According to the law on inheritance in Russia, the property of a deceased person can be accepted by his successors under a will or legal relatives, who are in one of seven orders. According to Article 1119 of the Civil Code of the Russian Federation, even before the moment of his death, the testator has the opportunity to independently determine his successors.

For this purpose, you need to draw up a will, which is a special notarized form. The testator has the right to indicate the following in the document:

- List of heirs (there can be one recipient or any unlimited number of successors).

- The amount of the share in the property that will be allocated to each recipient.

- Conditions for entry and receipt of inheritance.

- Executor of a testamentary document.

According to Article 1122 of the Civil Code of the Russian Federation, the testator can assign a certain part of the inheritance to each applicant. If there is no such condition, then the property will be divided equally. When inheriting an indivisible object, for example, an apartment, shares in the property will be determined for the recipients.

Based on Article 1126 of the Civil Code of the Russian Federation, the testator may not disclose the names of successors or unworthy recipients to anyone, including a notary. The closed will is given to the lawyer in an envelope on which a mark indicating its acceptance is placed. What to do if there is no will?

The right to inheritance according to the law in Russia provides for the transfer of left-behind property to close relatives of the deceased, if other applicants were not determined by the will. In the absence of a will, one of seven categories of relatives of the giver will be called upon to inherit. Thus, the following can accept entry by law:

- Children, parents, husband or wife of the deceased as first-degree successors.

- Grandparents, sisters or brothers of the deceased as second priority recipients.

- Uncles and aunts are heirs of the third order.

- Great-grandparents can enter as fourth-round successors.

- Great-aunts, grandfathers and grandchildren of the deceased are fifth-degree successors.

- Sixth cousins and aunts and nephews of the testator can inherit.

- The last, seventh order is the stepmother, stepfather, stepsons and stepdaughters of the giver.

The main successors of a citizen by law are his closest relatives. According to Article 1142 of the Civil Code of the Russian Federation, the priority of entry belongs to the children, parents and spouses of the deceased. Common-law spouses and deprived parents cannot inherit property.

When registering an inheritance according to the law, applicants must prove to the notary their relationship with the testator. For this, you may need birth, adoption, and marriage certificates.

If one of the successors has committed a crime against the testator, other heirs or the estate, then such a claimant can be recognized through the court as unworthy of the right to inherit and excluded from the number of heirs.

Basic principles of inheritance law. Inheritance legislation

The Constitution of the Russian Federation in paragraph 4 of the article devoted to the right of private property of citizens (Article 35) indicates that “the right of inheritance is guaranteed.”

For the Russian state, society and citizens, such a guarantee is not an empty slogan: in Ch. 1 of this work, we followed the “somersaults” of domestic inheritance law, expressed in certain regulations; another matter is the constitutional norm and its content in legislation.

Inheritance law in the objective sense is a set of legal norms governing the transfer of rights and obligations from the deceased to other persons (hereditary relations and relations related to inheritance).

Inheritance law in the subjective sense, on the one hand, is the right of a citizen to transfer his property rights and obligations to his heirs, on the other hand, the right to receive property rights and obligations as an inheritance from the testator (the right of inheritance).

Inheritance law covers a wide range of legal relations and not only private law ones. The main thing, of course, is the inheritance legal relationship, the rest are of an auxiliary, accompanying nature.

An inheritance legal relationship arises with the opening of an inheritance (after the death of a citizen) and ends with the acceptance of all inherited property. Inheritance legal relations are intermediate in nature from death to the legal acceptance of the inheritance, and they have a kind of retroactive effect. As soon as a citizen has acquired an inheritance, and his right to this arises from the moment of the death of the testator, it does not matter how much time has passed, i.e. how long “the inheritance lay” - six months, a year, two... According to the fair judgment of A.G. Didenko, “the completion of the development of the inheritance legal relationship is the moment when the heir becomes the subject of the rights and obligations that the testator had. Usually this moment is called “acceptance of the inheritance” ... ".

Discussing the state of the rights and obligations of the deceased in the period between death and acceptance of the inheritance, S.A. Muromtsev wrote: “In this intermediate period, rights exist temporarily without a subject (and obligations - debts - without an object). There is no need to allow such an existence to last forever; but it is necessary to accept it as a temporary existence.”

Without denying the problematic nature of the intermediate period, V.N. Nikolsky wrote at one time about the legal fiction of continuity of rights and obligations: “The transfer of the legal relations of the deceased to a new person is accomplished here through a legal fiction at the time of death or disappearance.

This legal fiction is nothing more than an expression of the continuity of legal relations, legal life.”

The basic principles of civil legislation are set out in Art. 1 Civil Code of the Russian Federation. In accordance with paragraph 1 of this article, civil legislation is based on the recognition of the equality of participants in the relations regulated by it, the inviolability of property, freedom of contract, the inadmissibility of arbitrary interference by anyone in private affairs, the need for the unhindered exercise of civil rights and ensuring the restoration of violated rights and their judicial protection. The basic principles of law, connecting together and cementing sectoral institutions, sub-institutions and categories, are of particular importance for the civil law sector, which is characterized by extremely high variability in the behavior of participants in regulated legal relations, the diversity and casuistry of the applied rules, and the dispositive model of legal technology of most of them. Of course, the basic principles (principles) of civil law, with certain specifics, also apply to inheritance legal relations.

We believe it is necessary to consider them taking into account the modern development of both socio-economic and legal relations.

The principles of modern Russian inheritance law include:

freedom of will. The testator has the right to bequeath property to any persons in any proportion, cancel and change the will. The restriction is possible only if there are citizens who have the right to an obligatory share in the inheritance. Unfortunately, the modern principle of freedom of will does not make it possible to dispose of property in the event of death using a joint will of spouses or an inheritance agreement. We believe that a fairer beginning of inheritance law should be the principle of freedom to dispose of property in the event of death;

priority of a will over inheritance by law. Inheritance by law occurs when there is no will, when the will is invalid in whole or in part, or when not all property is bequeathed. In such a legal structure, inheritance by law fills the gap associated with the absence of a formally expressed will of the testator;

the absence of quantitative and qualitative restrictions on the inheritance of property, with the exception of property withdrawn from civil circulation or limited in it; in public law, this principle is reflected in two related rules: first, in most cases there is no inheritance tax (with the exception of the inheritance tax on objects of intellectual rights); second, despite the persistent desire of the left opposition to change the situation, if there is no tax itself, then there is no progressive inheritance tax, which exists in many states;

universality (integrity) of the hereditary mass. Inheritance is a universal legal succession. Both the assets and liabilities of the testator are inherited: you cannot refuse part of the inheritance, you can accept the entire inheritance, including property and debts, or refuse it. At the same time, in modern legislation, the liability is limited to the asset;

calling on persons entitled to an obligatory share to inherit, regardless of how the inheritance occurs: by will or by law;

maximum involvement of legal heirs in the inheritance process in the absence of disposal of inherited property. There are eight lines of succession by law. In this case, the subsequent queue inherits in the absence of the previous one. Inherited by relatives both in descending and ascending lines of kinship, adopted children and adoptive parents, stepmothers, stepfathers and stepdaughters, stepchildren, disabled dependents;