The Federal Bailiff Service (FSSP) has created guidelines for meeting the requirements for collecting alimony. The recommendations were approved in 2012 and are still in effect.

Typically, alimony is applied for after a divorce, although it is possible to do this during marriage. There are many nuances in the law that parents should consider before filing a claim. You need to know how alimony is calculated correctly, where to apply and what package of documents to collect. Let's look at these nuances in more detail.

Rules for payment of alimony

Minor children can apply for alimony (the claim is filed on their behalf by a legal representative), as well as parents, and in some cases, a spouse.

The legislation establishes 2 methods of payment:

- treaty;

- judicial.

If a voluntary agreement has not been drawn up between the spouses, then the transfer to support the children is carried out on the basis of a court decision. For 1 child the payment is ¼, for 2 children - 1/3, for 3 or more - ½. All parents' income is taken into account. Sometimes, by court decision, it is possible to recover a fixed amount. According to the Family Code, the amount of alimony paid in a fixed amount is approved on the basis of the subsistence level. All circumstances of the payer (the presence of other children and dependents, other obligatory expenses) and the recipient of alimony are also taken into account (the court may take into account the need for paid treatment, etc.)

When the court has made a decision, the documents are sent to the bailiffs, and the FSSP makes the calculation and collection. Usually, alimony is calculated from the moment the claim is filed; sometimes it is possible to collect it for the previous 3 years.

General principles for paying alimony

What do child support guidelines include? This is the calculation of debt, types of enforcement documentation, the procedure for indexing finances, types of income from which deduction occurs, as well as the search for debtors. All these sections are based on a number of general principles and rules.

The manual states that any incapacitated persons can apply for financial assistance. Most often these are minor children. In this case, two parents agree on the calculation and receipt of financial assistance, or conduct proceedings within the walls of the court.

A voluntary agreement involves setting any monetary amount as payment. During the trial, regular payments will be established, levied as a percentage of the income received. So, for 1 child ¼ of the share is due, for two children 1/3, and for three children – half of the payer’s total earnings.

According to the Family Code, the amount of payments should be based on the subsistence level. Financial content is subject to mandatory indexation. If the payer has a debt, then the FSSP takes over the matter. All necessary documentation is transferred to this service, after which the actual collection occurs.

Rules for indexing alimony

Methodological recommendations include the possibility of indexing. The calculation of payments will depend on the cost of living. It may be different in each region, so the payer’s place of residence is taken into account.

Example. The payer has one child, the cost of living in this region is 6,500 rubles. The defendant’s salary is 15,000 rubles, so 1/4 of the payer’s income is 3,750 rubles, which is less than the minimum subsistence level. In this case, the court may order a payment of 6,500 rubles.

If alimony obligations to support one child are terminated, the amount of payments to support other children changes. Methodological recommendations include rules for collecting money if one of the children has become an adult.

In these cases, 3 months before the child’s 18th birthday, the payer must go to court, which will allow him to change the calculation of funds.

Payments end in the following cases:

- the child has become an adult and capable;

- the minor was officially adopted;

- the recipient has become able to work;

- death of the recipient or payer of alimony.

The FSSP collects debt on the basis of a writ of execution, as well as an order or agreement.

The legislation specifies the following requirements for writs of execution:

- they must comply with the rules prescribed in Art. 13 Federal Law No. 229;

- The details are established in Art. 127 Code of Civil Procedure of the Russian Federation;

- the agreement is drawn up in accordance with the provisions of Chapter. 16 IC RF.

If the original writ of execution was lost, then a duplicate is submitted to the bailiffs for execution.

You may also be interested in:

- Review of judicial practice on the collection of alimony

- Collection of alimony - procedure, payment, judicial practice

- Jurisdiction of cases of alimony collection

Watch also the video about the nuances of collecting alimony:

//www.youtube.com/watch?v=GatKm7NKbbE

Indexation of deductions

The FSSP's methodological recommendations on alimony include some instructions on how to perform indexation. By law, indexation affects the amount of debt. The bailiffs themselves handle the calculations. They are based on the cost of living. It is known that it is different in each region, and therefore the place of residence of the payer must also be taken into account.

At the end of the maintenance of one child, the amount of money for other children changes. The manual states that the payer must apply to the court to change the calculation of finances at least 3 months before one of the children comes of age. If there were two children to support, then from 33% for both persons the cost will increase to 25% for one person.

A complete cessation of payments is possible in the following situations:

- death of one of the parties (recipient or payer);

- adoption of a minor;

- obtaining the ability to work by a recipient who previously had the status of a needy person;

- registration of a new marriage by the recipient;

- adoption of a minor, and therefore the appearance of two parents.

Only bailiffs have the right to collect debts. They issue a special writ of execution on the basis of which the sentence must be executed. If the sheet is lost, a duplicate is issued, for which you need to go to court.

What amount is deducted from wages?

The FSSP submits documents to collect alimony from wages and other sources of income. The recommendations include rules for debt collection when determining a place of work, study, or pension.

The following documentation is sent to the place of work:

- copy of the writ of execution;

- resolution on appeal;

- a copy of the penalty order;

- a copy of the fine;

- rules for managers to retain money.

The documentation sent by the judicial authority must be recorded by the accountant in the journal. After this, payroll calculation occurs. The accountant sends a notification to the FSSP that the documents have been received.

It is important for accountants to know the following:

- judicial authorities can check the debtor;

- The amount is calculated after taxes are deducted.

By law, more than 50% of salary and other income can be withheld. Deductions are carried out in full on the basis of the requirements specified in the decision.

Example. The claim for alimony was filed on April 1. The case was considered on April 31, and the court ruled in favor of the plaintiff. But the defendant filed a counterclaim to determine the child’s place of residence with him. A new hearing was scheduled. The court did not agree with the defendant's arguments and upheld the first decision. The final decision was made on July 1. Thus, the plaintiff must receive child support in the amount of 25% for one child starting April 1. Since he cannot receive the first payment before August, for the first months (April - July inclusive) the defendant will pay 50% of the salary. When he pays off the debt for these months, the payment will be reduced to 25%.

Even if there are several writs of execution, wages remain at least 50%. Child support is calculated by an accountant and paid within 3 days after the payment of wages.

If the amount of payments is set as a fixed amount, indexation is carried out in accordance with the minimum wage in the region so that the provision for the child is appropriate.

Alimony will be deducted from a pension or unemployment benefit if the payer is unemployed, but funds cannot be deducted from one-time transactions. If there are several writs of execution, then the deduction occurs in turn. Money is transferred to a current account or by mail. The change of job must be reported to the judicial authorities that carry out the recovery.

Calculation of deductions from income

If there is no fact of voluntary payment of finances, the FSSP submits documents to collect a share from the money earned by the payer. The same procedure is implemented in case of debt, as well as in the following cases:

- when the volume of payment does not exceed 10 thousand rubles;

- the debtor does not have the finances to repay the debt;

- Irregular payments are collected.

The grounds include compensation for harm, fines, alimony obligations, taxes and offenses. The recommendations include standards for paying debts when determining a place of study, work or when assigning a pension. If the amount exceeds 10 thousand rubles, a deduction must be made from all sources of income.

The following types of documents are sent to the place where the debtor is employed:

- a copy of the penalty;

- resolution on appeal;

- copy of the writ of execution;

- standards for management of financial retention;

- resolution on appeal.

All documents sent by the court must be recorded in the journal. After this, wages are calculated directly. The accountant sends a notification to the FSSP about receipt of the papers, after which he stores them in a safe as strict reporting.

Who is child support paid to?

You can receive alimony:

- minor children;

- disabled children;

- wife during pregnancy;

- spouse (s) in case of incapacity for work or while caring for a disabled person.

Collection principles may differ among different groups.

Non-payers of alimony bear administrative or criminal liability. If the accounting department does not fulfill the necessary requirements for collecting money from the payer, then a protocol on an administrative offense is drawn up. In this case, a fine is required to be paid, the amount of which depends on the status - official or citizen. In case of malicious evasion of the obligation to pay security, criminal liability arises.

Alimony within and outside of marriage. Accrual methods

Children are entitled to maintenance payments from their parents, regardless of whether they are married or not. If the child was born out of wedlock, then confirmation of paternity is necessary. It can be voluntary or carried out in court. The second option is necessary if the father is not listed on the birth certificate and refuses to acknowledge himself as the father.

Typically, alimony is established in shares, regardless of whether the marriage was registered or not. If an agreement has not been drawn up between the former spouses, or the other party’s income is unstable, then payments are assigned in a fixed amount. Although there are general rules for calculating maintenance, in each case only the court determines the amount and procedure for collection.

Methods of paying alimony

You can choose a payment method voluntarily or through the courts. It is more convenient to conclude an agreement that must be notarized. In this case, lengthy legal proceedings are not required; you just need to write down all the nuances in the document. If in the future one of the parties violates the obligations, the agreement will have legal force as a writ of execution.

If there is no agreement, legal action remains. In this case, there are 2 procedures:

- simplified;

- ordinary.

The first option is used when the payer’s place of residence is known and there are no fundamental disagreements.

How is the amount of alimony determined?

The calculation is made by the court. If an agreement has been drawn up, then alimony should be no less than that established by law.

Since financial support for minors is the responsibility of both parents, the judge takes into account their financial situation. The law states that the amount of payments for a child cannot be more than 50% of the salary, but in some cases it is set at up to 70%. To increase the amount of the payment, the recipient needs to justify the expenses.

Payment transfer methods

After determining the amount of payments, it is necessary to agree on the method of transferring the money. Typically a bank account or card is used. There are other options: mail, money transfers.

If the payer is registered as an entrepreneur, then he can transfer money in cash. In this case, you need to take receipts or receipts. In the case of a money transfer, the payer bears the costs of sending.

To apply you need:

- birth certificate of a minor;

- Marriage certificate;

- photocopy of passport;

- certificate of family composition.

Documentation is attached to the statement of claim. If there is information about the place of work and income of the rights violator, the procedure is performed in a simplified form.

After considering the case, the court makes a decision and a writ of execution is issued. The plaintiff needs to contact the FSSP to repay the debt. Employees will check the payer’s income, and independently calculate and make collections. A penalty of 0.5% per day is collected on the amount of debt.

How do you get the amount of debt based on the cost of living?

If the amount of debt is obtained on the basis of the subsistence level, then the amount of income of the debtor is not taken into account. Alimony payments can have different amounts, which are influenced by the circumstances of the case being considered by the bailiff. It is worth noting that the amount of the subsistence minimum changes quarterly, and therefore regular payments are indexed. In this regard, when submitting an application for debt calculation, the bailiff takes into account current data on the PM as of the date of drawing up the enforcement document.

The formula for calculating alimony debt in this case is drawn up in the following order:

- monthly payments are established that correspond to the cost of living in the region or country;

- the amount received is multiplied by a multiple of the subsistence level previously established by the court;

- the obtained data on the monthly amount of payments is multiplied by the period of non-payment of alimony.

For example, with a living wage of 15 thousand rubles, a debt of 10 months and alimony multiplicity equal to 2 monthly minimums, the total amount of debt will be 300 thousand rubles for the previously specified period.

Alimony after 18 years

Many people have to apply for child support after turning 18. Although it is believed that a person from this age can provide for himself, there are still cases when payment is possible even after adulthood. In Russia, payments are provided only to disabled people. In other cases, at the age of 18, the accrual of alimony stops, even if the child is still in school at that time.

If a child has entered full-time study at a college, school, university or institute, an application can be made to the court, which will determine whether maintenance is needed or not. But as practice shows, courts rarely satisfy such claims.

Alimony for the mother of a child under 3 years old

Child support is paid not only to children, but also to the parents who raise them. They are usually prescribed for up to 3 years.

Payments are due:

- pregnant wife;

- spouse until the child reaches 3 years of age.

When filing a divorce, the ex-spouse can file for alimony. Everything is assigned by the judge based on the documents provided.

Alimony for a disabled child

The law establishes the right of a disabled child to receive financial support. Restrictions are related to the disability group, and this is determined by a medical examination.

Such alimony is also established voluntarily or compulsorily. In the first case, you will need to draw up an agreement that specifies the procedure, amount and nuances of providing funds. Additional expenses must be justified by the recipient. Once completed, the document must be notarized. This procedure is also required when changing or terminating the agreement.

If an agreement is not drawn up, then the issue is resolved in court. Even if a disabled person receives an additional pension, benefits, and alimony, he is still entitled to it. Moreover, a disabled child is entitled to alimony even after the age of 18, if by this age he has not lost his disability and has not become able to work. The main document for obtaining alimony is the statement of claim. It must be compiled in 2 copies. It is also necessary to prepare documents: birth certificates, marriage certificates, divorce certificates.

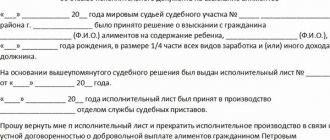

How to draw up an application for calculating arrears of alimony

If alimony has not been paid for a long time, the recipient of the funds has the right to file an application to collect the debt from the payer. This type of document is handed over to the bailiff, who will subsequently establish contact with the debtor and draw up a resolution on alimony arrears.

The application for calculation of alimony arrears is drawn up in free form. You must have at least one copy of the document with you, which will indicate the exact date of submission of the application. In the future, this will help to avoid problems with calculating the exact amount of non-payment. After drawing up the document and submitting it to the bailiff, the calculation of alimony debt by the bailiff must begin within 13 days from the date of registration of the application. A copy of this document is sent to the debtor and the collector of the monthly deduction as soon as possible.

A request to create this type of document can be issued either by the recipient or by the debtor himself. In addition to the amount of alimony itself for the entire unpaid period, additional funds may be withdrawn from the payer for a penalty. It is also possible to index the amount based on current information about the debtor’s income or the minimum wage in the country. In some cases, a court decision may increase the payer's initial monthly payment amount.

If after 13 days the recipient’s application has not been considered, he has the right to file a complaint with the court and inform the bailiff about the inaction. The period allotted for drawing up a statement about the unlawful actions of a judicial representative is 10 days.

Where to go to calculate alimony

To receive alimony, you must go to the Magistrates' Court. When you know where your spouse lives, you should contact him at his place of residence. In other cases, a justice of the peace will do. If children were born out of wedlock, then it will be easier to collect child support when the father is indicated on the birth certificate. If paternity needs to be established, you must go to the district court.

The application from the magistrate judge goes to the district judge if the father files a petition to establish paternity. This also happens in cases where the amount of payments, in his opinion, is exceeded. To collect a debt, you must go to the magistrate's court. An example of a claim is here.

The district court decides the following issues:

- establishes maternity and paternity;

- when parents cannot decide with whom the child will live;

- if one parent prohibits the child from communicating with the other;

- when restriction or deprivation of parental rights is required.

It happens that alimony is issued, but it is not transferred. If conversations do not help and the delay has reached six months, bailiffs will help solve the problem. They can also issue a certificate on the basis of which you can apply to the Prosecutor’s Office or the court.

Such measures are considered the most effective. The bailiffs have information about the payer’s income: if he works, they send a writ of execution. Appealing to the prosecutor threatens to open a criminal case, and the punishment is correctional labor or arrest. Read on for details on how to sue for child support.

Legislative framework for payment of alimony

Before calculating alimony debt, it is worth familiarizing yourself with the main legislative documents that regulate the issue of calculating alimony. This will help to obtain accurate information about the responsibilities that the father of the children must fulfill if their mother, who is not the man's spouse, is the guardian. The following regulatory documents are mainly used:

- Family Code of the Russian Federation.

- Decree of the Government of the Russian Federation No. 841 of July 18, 1996

You should also read additional information on this topic, which can be found in the Federal Law on Enforcement Proceedings and the Civil Code of the Russian Federation. This will help to obtain accurate data about the obligation to pay and the correct calculation of alimony.

If difficulties arise in receiving payments from the alimony payer, the interested person can find out all the information he needs on the website of the FSSP bailiffs. In addition to the amount of alimony, it indicates the existence of a debt and its exact amount.

Alimony to parents

Parents also have the right to receive support from their children. Alimony is assigned to disabled parents, for example, upon the onset of disability or upon reaching retirement age. In accordance with the 2021 amendments, even people of pre-retirement age can qualify for alimony.

The amount of security is determined based on the payer’s income and the cost of living, which is different in each region. Child support is paid by an adult child. Only an able-bodied person can pay money.

To assign alimony, you must submit an application to the Magistrates' Court. When determining the amount of child support, the expenses of the parent and the child are taken into account. Income and marital status must be taken into account. Alimony can be assigned in a specific amount and paid every month. Even if the application is filed for one child, the court may call other children.

In case of deprivation of parental rights, adult children are released from parental support. Children are also exempt from payments in cases where parents shied away from their responsibilities. In this case, the defendant is required to provide a document with evidence of evasion of obligations.

Features of debt calculation

The method by which the debt is calculated directly depends on the previously issued court order or the agreement drawn up by the parties. Each case has its own articles in the legislation of the Russian Federation. Basically, when obtaining information about the amount of debt, the following are taken into account:

- data on the cost of living of the region or country in which the alimony recipient lives is taken into account;

- average earnings in the Russian Federation are taken into account;

- if the debtor is officially employed, the amount of debt is calculated in accordance with his income.

Taking into account the above data, alimony debts may vary among different payers.

What payments can be assigned other than alimony?

In some cases, you can demand not only alimony, but also compensation for other expenses, usually of a medical nature. These include payment for treatment, care, purchase of medications, i.e. everything related to health. Adult children are also entitled to compensation for additional expenses.

But for this it is necessary to prove that the child needs these expenses. The financial situation of the parties must be taken into account. The claim must be filed in the prescribed form before the magistrate. Payment of additional expenses is assigned in a fixed amount. Medical documents will serve as confirmation. The period for providing compensation may or may not be established (indefinite). If the claim is satisfied, the costs will be deducted from the payer. Together with alimony, they cannot be more than 70% of his income.

What you can do right now:

- Carefully study the recommendations for collecting alimony from the FSSP;

- Study the specifics of calculating alimony;

- Watch the video presented in the article;

- Read additional material on this topic: 10 main questions regarding the collection of alimony