Features of the procedure

The process affects the following indicators of the real estate:

- Square.

- Materials of manufacture, as well as the age of the building.

- Layout.

- Availability of amenities (elevator, parking).

- Location of the object.

- Floors of the building.

- Distance to transport interchange.

- Infrastructure.

Regarding plots of land and non-residential real estate, parameters that interest the consumer are used. The Cadastral Chamber contains a list of property objects that are subject to assessment. The procedure is carried out only by specialists with the necessary qualifications.

The amount of property tax will depend on the results of the work. It is also necessary when transactions involving the sale or division of real estate are made.

ATTENTION! If the size of the cadastral value does not suit the owner, then there is the opportunity to appeal it.

A cadastral valuation is given to all real estate. This includes plots of land, residential and non-residential buildings, apartments, etc.

During their work, appraisers use a mass valuation technique, which may result in discrepancies between the market and cadastral value of real estate.

How to challenge the cadastral value

To correct a technical error, contact the commission at Rosreestr. It is much more difficult to prove that the cadastral value, despite the absence of errors, is much higher than the market value. You can’t just come and say you don’t agree. It is necessary to hire an appraiser who will draw up a report on the market price of an apartment or plot. He can be from any region. But you can’t use the services of just anyone. The appraiser must be a member of a self-regulatory organization of appraisers, which is responsible for the quality of the work performed and the professionalism of its members.

This year, a law came into effect according to which real estate tax is calculated based on its cadastral value. However, Russian courts have received massive lawsuits from citizens who do not agree with the valuation of their real estate. The Arkhangelsk region was no exception. In some cases, the cadastral value of housing in the region is five times higher than the market price.

Across the country, cadastral valuation of acres and square meters is currently underway. Its citizens will feel the results not now, but next year, when they receive tax notices. But it is obvious that in any case you will have to pay more. Previously, the apartment was valued according to BTI calculations, which were much lower than the market value of the property. Accordingly, the tax was invisible to many. But starting this year, rates have increased sharply: the tax percentage is taken from the cadastral value of the apartment.

For example, the annual tax on a standard one-room apartment, which, according to the BTI, costs 450 thousand rubles, was 1,350 rubles. And according to the cadastral assessment, the price of the apartment is seven million rubles. Accordingly, the new tax could amount to seven thousand rubles.

Who is guilty?

Since August last year, people in robes have already received more than 6,000 applications from citizens dissatisfied with the assessment of their real estate, Rossiyskaya Gazeta reports. In their opinion, housing costs less than it was calculated. The courts are trying to sort this out.

The fact is that the value of an apartment is assessed by appraisers specially selected by local authorities. However, they are living people and, like everyone else, they can make mistakes. Moreover, the assessment is usually carried out en masse, and the individual characteristics of the apartment are not taken into account. After all, appraisers don’t visit guests; they don’t look at repairs, views from windows, curtains, or evaluate them.

“I live in a one-room apartment in Factoria, in a five-story building. My apartment was valued at almost two million. This is simply an unrealistic cost for my home. Firstly, this is far from the city center, and secondly, the house is old, and our area is not the most prosperous. It is not known where the appraisers got this value from,” said Arkhangelsk resident Alexey Sukhanov

.

The Office of Rosreestr for the Arkhangelsk Region and the Nenets Autonomous Okrug explained that in Pomorie a mass cadastral valuation of real estate was carried out in 2012. The assessment work was carried out by Rosreestr employees from Yaroslavl.

Probably, errors in the assessment are caused by the fact that specialists did not come to the Arkhangelsk region in person, but carried out a cadastral assessment of real estate using unverified data and maps. Apparently, the distance to the city center was not taken into account, as were many other criteria. So it turns out that the cost of housing on the outskirts in some cases exceeds the prices in the central areas.

What to do?

The northerners will have to take the rap for the mistakes of Yaroslavl specialists on their own. Rosreestr has even created a special commission to resolve disputes. The Law on Valuation Activities provides two grounds for revising the results of cadastral valuation:

- unreliability of information about the property used in determining its cadastral value;

- establishing in relation to a real estate object its market value on the date as of which its cadastral value was established.

If a citizen is dissatisfied with the results of the cadastral valuation and the decision made by the commission, he can challenge this decision in court.

The statement of claim is submitted to the executive body of the constituent entity of the Russian Federation, authorized to make a decision on conducting a state cadastral valuation on the territory of the constituent entity of the Russian Federation.

But first, it is necessary to analyze all possible options for judicial resolution of the dispute, to understand what claims and to whom should be brought in a given situation. Going to court is not that simple. There are several options for establishing the price of real estate in court. For example, file a claim to establish the cadastral value of a land plot equal to its market value, while the market value is established by the court on the basis of an appointed forensic examination.

The problem is that a unified judicial approach to these issues has not yet been developed. Therefore, citizens are recommended to seek help from lawyers who specialize in solving such problems.

The Plenum of the Supreme Court of Russia is currently preparing a draft resolution that explains in detail the issues related to the valuation of real estate. After the document is adopted, a lot of problems should disappear, as certainty will appear.

The game is not worth the candle

However, employees of Arkhangelsk appraisal companies believe that for owners of ordinary (not luxury) housing, challenging the results of a cadastral appraisal is a very unprofitable procedure.

“Those citizens who do not agree with the cadastral valuation of their property should carefully calculate how much all the contestation procedures will cost them and think about whether they will remain in the red after this? After all, you can prove that your assessment does not correspond to the mass cadastral one only by making a market assessment for a specific object. Market valuation of housing is not a cheap procedure. The price of the document varies from 2.5 to five thousand rubles. In court, additional examination will likely be required. And these are new expenses - around 10 thousand. Plus, someone will also need to pay for a lawyer,” said Eduard Vorobiev, CEO of the appraisal company.

. “So it turns out that the costs that the homeowner bears for the assessment procedure, challenging the cadastral value, etc. will be many times greater than the cost that he will save in the future on taxes.”

According to Eduard, only owners of elite and individual housing will be able to benefit from such disputes and not be left in the red.

Information about the cadastral value can be obtained from the cadastral chamber in person or by sending a request by mail. Inquiries can also be made at multifunctional centers or through the Rosreestr portal. Moreover, at the request of the citizen, the certificate can be provided both electronically and on paper.

Already, many Russians who have decided to find out the valuation of their dacha or apartment are surprised: “Why is it so expensive? Where did this figure come from?

Anton Sonichev, a lawyer at the Business Fairway bureau, a legal expert, told AiF

.

Necessity

The following situations are distinguished:

- Sales transaction. When determining the price of an apartment for sale, it is sometimes difficult to find similar objects to compare indicators with. In this case, it is convenient to refer to the cadastral value.

- Transfer for rent. According to the rules for providing municipal housing to citizens for rent, its rent is determined on the basis of cadastral valuation data.

- Inheritance or gift of real estate . During a transaction, they are sometimes required to indicate the value of the object.

- Registration of subsidies for property tax calculation. Tax transfers provide certain benefits. For their correct calculation, not only the area is required, but also the cadastral value of the property. The size of the subsidy will depend on its size.

- Loan or mortgage secured by collateral . When contacting a bank, the credit department may ask for a new cadastral valuation of real estate. This is necessary if the actual data in the Unified State Register does not meet the client’s needs.

The new valuation methodology makes it possible to bring the value of real estate as close as possible to the market value, which allows you to increase the loan amount that the bank will approve.

Procedure for calculating cadastral value

Properties are valued as part of the cadastral registration process. This happens in several cases:

- emergence of an object - commissioning of a house, formation of a plot for individual housing construction, allocation of land for economic and other needs;

- changing its characteristics - re-registration of a residential apartment as commercial real estate, alienation of part of a land plot, extension to a house, etc.

State cadastral valuation of real estate is also carried out regularly. In a certain area it can be carried out en masse or on a specific object. The cadastral value is calculated on the first of January of the year for which the tax has already been calculated.

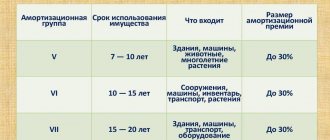

Frequency norms for assessing cadastral value

Basis: Order of the Ministry of Economic Development No. 953 dated December 18, 2015 with explanation and art. 24.12 Federal Law on valuation activities in the Russian Federation.

- State - at least once every 3 years, sometimes less often. But be sure to recalculate the cost every 5 years.

- In special subjects - Moscow, St. Petersburg and Sevastopol are included in this group, here it is recalculated every 2 years.

- Non-state assessment - when challenging the official examination, if the owner is sure that the cadastral value does not correspond to reality, for example, it is too high. The customer pays for such an assessment, since it is he who is interested in the revaluation.

How to find out on what basis the cadastral value was assessed?

Data on the information used in the formation of the cadastral value for a certain object is stored in a special Fund. You can access them through the same Rosreestr using its number.

The full report on the assessment process can be downloaded as a folder and viewed privately. It contains, among other things, the following information:

- name of the authority that ordered the assessment;

- date of report approval;

- Full name and position of the expert who conducted the assessment.

You can apply for the report in person to the City Property Department or the Rosreestr branch. Clarifications must be provided within 30 working days.

What if you need to get it faster?

Yes, this is also possible by contacting commercial services that provide this certificate within three working days.

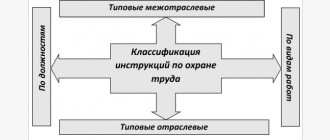

Who conducts

The property valuation procedure is carried out by professional appraisers who have documented evidence of their qualifications. They are selected by the local administration on a competitive basis. The selected specialist signs an agreement with local authorities, on the basis of which he performs his duties.

The results of the assessment are reviewed by government agencies, approved and then transferred to Rosreestr.

ATTENTION! Appraisers have the right to choose a method for calculation at their discretion.

Challenging the inflated cadastral value of an apartment in court

If you decide to independently prove in court that the cadastral value of your home is incorrect, you must take the following steps

- Apply to the court at your place of residence with an administrative claim, drawn up in accordance with the regulations of the Code of Administrative Proceedings of the Russian Federation.

- Submit a package of documents:

- a certificate of the cadastral value of the apartment indicating the date on which it was determined

- copies of title documents for real estate, certified by a notary

- a report on the assessment of the market value of the property, compiled by an independent expert as of the date on which the cadastral value was determined; the report must have a positive conclusion about its compliance with the requirements of the law (issued by the SRO of the appraiser)

- all documents and data indicating the presence of errors in the cadastral valuation report, unreliability of information about the object used in determining its cadastral value, and any others relevant to the case

- receipt of payment of state duty

- Attend court hearings.

When challenging the cadastral value of an apartment, you will need to prove to the court the validity of your claims, in accordance with current legislation. Without a legal education, this is extremely difficult to do. Therefore, it is recommended to carry out the procedure with the participation of professional lawyers. The cost of their services to support such cases starts from 30-50 thousand rubles (Moscow prices), the total amount depends on the complexity of the procedure and the scope of actions of the plaintiff’s representative.

Order of conduct

To carry out the procedure, you must submit a written application in the prescribed form to Rosreestr or the Cadastral Chamber. Before submitting it, a list of documents is first collected:

- Documents establishing the right to own property.

- Inspection report. It is necessary to deregister a property.

- Land survey plan.

- Technical plan.

- Papers defining the category of land.

- A document confirming payment of the state duty.

You can provide copies of documents. Additional paperwork may be required depending on the type of property and its location.

Based on the submitted application, an agreement is drawn up with the applicant containing a list of objects that require assessment. Then information about the real estate market is collected, as well as its analysis in relation to the object.

Only this information will make it possible to bring the market value as close as possible to the cadastral value. After which it is determined, based on the results of which a report is drawn up. Its size can be influenced by several factors that determine the final cost of real estate.

Where to file a complaint about an assessment

Individuals can submit an application for overestimation of the cadastral value of real estate to the commission for the consideration of disputes about the results of determining the cadastral value at the regional department of Rosreestr. And if this doesn’t help, then go to court. You can go to court immediately, bypassing the commission (Article 24.18 of the Federal Law of July 29, 1998 No. 135-FZ). It’s easier to complain to the commission, and it’s free. Therefore, if we are talking about technical errors, then it is better to start with it. It's another matter if you simply consider the assessment to be biased. In such disputes, officials rarely support property owners. Therefore, it may be worth spending money on the state fee and going directly to court. This way there is a greater chance that the cadastral value will be recognized as inflated compared to the market value.

The cadastral value of real estate and land owned by individuals is often inflated due to technical errors. One of the most common mistakes is the incorrect type of permitted use. Appraisers, with the broad formulation “housing construction”, automatically classified the site into the group with the maximum cadastral value - “location of multi-storey residential buildings”. In fact, low-rise private houses stood on this site. In such cases, to adjust the cadastral value of the plot, it is enough to contact the Federal Property Management Agency.

results

The results of the appraisers’ work procedure are subsequently reviewed and approved by a special commission under the local administration. All information is entered into the Cadastral Chamber with the assignment of the State Property Committee.

The cadastral valuation is measured in rubles and can be reflected in documents such as a cadastral passport, certificate or certificate of ownership.

IMPORTANT! It is the valuation of real estate that is the basis for calculating property taxes.

How can you reduce the cadastral value of an apartment?

There are three ways to reduce the cadastral value of an apartment. How to do it?

- Apply directly to the appraiser.

- Contact the dispute resolution commission about the results of determining the cadastral value at the territorial branch of Rosreestr.

- File a lawsuit.

You can find out who exactly (which organization/private appraiser) appraised your property under a contract with the Cadastral Chamber on the Rosreestr portal if you know the cadastral number of the apartment. Or you can personally visit the office of the Federal State Registration Service with the appropriate application, or alternatively, send it by mail.

Having identified an appraiser, you should submit a request to him to identify and eliminate errors in the report to establish the cadastral value of your apartment. Unfortunately, in most cases, contractors under state contracts for cadastral valuation are not interested in confirming their own mistakes. If the issue cannot be resolved voluntarily, you will have to go to court.

Appeal to the dispute resolution commission is carried out by filling out an application for review of the assessment results. It must be accompanied by:

- certificate of cadastral value;

- a report on the market value of housing with a positive expert opinion (issued by the SRO appraiser, costs about 10 thousand rubles) - on paper and in electronic form;

- copies of title documents for the object certified by a notary;

- documents indicating the unreliability of information regarding the object that was used to determine its cadastral value and influenced the outcome.

The application is considered no longer than a month. Challenging the cadastral value of an apartment in the commission under Rosreestr also does not always end in a decision in favor of the applied property owner. If you are not happy with the verdict, the court can help.

Reducing the cadastral value of real estate step by step

The legislative procedure for reducing the cadastral value of objects is regulated by the following acts:

- Federal Law No. 237 “On State Cadastral Valuation” dated July 3, 2016 - establishes the principles and procedure for conducting the valuation;

- Resolution of the Plenum of the Supreme Court No. 28 of June 30, 2015 - regulates private situations arising when considering cases on recalculation of the cadastral value of real estate;

- Federal Law No. 221 “On the State Real Estate Cadastre” dated July 24, 2007 - provides clarifications about cadastral errors and inaccuracies that affect the assessment result;

- Federal Law No. 135 “On Valuation Activities” dated July 29, 1998, regulating the procedure for conducting valuation work on the territory of the Russian Federation.

Based on legislative guidelines, we can provide step-by-step instructions for reducing the cadastral value of real estate.

Step 1. Determining whether there are grounds for revaluation

If the owner has discovered that the cadastral value has been overestimated, it is necessary to make sure that the increase was unreasonable. As a rule, interest in the price of an object according to the cadastre data occurs after receiving a receipt from the tax office, which indicates a payment that does not suit the owner.

The amount of property tax directly depends on the cadastral value of an apartment, house or non-residential premises, so the advisability of reducing the price according to the cadastral data is obvious.

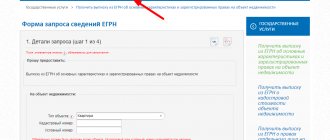

You can determine what data is contained in Rosreestr by obtaining an extract from the Unified State Register of Real Estate indicating the cadastral value. You can order an extract in several ways:

- Personal application to the territorial Rosreestr at the location of the property.

- Visit to the territorial MFC.

- Submitting an application for an extract through the State Services portal.

- Submit an application on the official website of Rosreestr.

- Submitting an application for issuance of an extract by mail. You will need to send a registered letter with return receipt requested.

Obtaining an extract is subject to a state fee. Its amount for citizens is 300 rubles, for legal entities – 950 rubles. You can pay at any bank branch or through the Internet banking system.

Next, you will need to compare the price indicated in the extract with the approximate value of the property on the market. You can view advertisements for the sale of similar objects. If the value in the statement is approximately 30% or more higher than the market value, then this is a serious reason for revaluation.

Another important point is that you can submit an application for revaluation no later than five years (and in some regions of the Russian Federation 2-3 years) after the date of change. This is due to the fact that after a set period a planned revaluation occurs. Its results can also be disputed.

Step 2. Contacting an appraisal company

To prove the difference between the market and cadastral value, you will need the opinion of a professional appraiser licensed to carry out such activities. Contacting an appraisal company is inevitable. An appraiser will analyze the documents and tell you how advisable it is to challenge the cadastral value of real estate.

Of course, the appraiser's services are paid. On average they will cost 7-10 thousand rubles. Prices vary by region.

If the appraiser confirms that the cost is too high, you will need to conclude an agreement with him to carry out appraisal work. The cost of preparing an assessment report depends on the complexity of the object and its location.

If inaccurate information contained in the unified register has been identified, you will need to obtain an appropriate conclusion. It is also done by an expert appraiser. The cost of the examination is 10-20 thousand rubles.

The prices are impressive. However, you can lose significantly more by paying an unreasonably high tax.

Step 3. Collecting documents

To begin the procedure for reducing the cadastral value, you will need to prepare a number of papers:

- an extract from the Unified State Register indicating the cadastral value;

- a copy of the title document - certificate of ownership, purchase and sale agreement, deed of gift, etc.;

- assessment report or conclusion on the unreliability of information in Rosreestr;

- general civil passport of the Russian Federation.

The institution will also need to fill out a standard application to reduce the cadastral value of real estate.

If any documents are missing or the data in them is untrue, the application will not be accepted.

Step 4. Contact the commission for resolving disputes regarding cadastral value

The commission will be formed in Rosreestr. Upon application, the owner will be given an application form, which indicates the owner’s personal data, as well as telephone number, address and email for communication. You will also need to set out the reasons for starting the process of challenging the cadastral value.

An application may not be accepted for consideration on the following grounds:

- there are no documents listed above;

- deadlines for submitting an application for revaluation were violated;

- The cadastral value of a property is identical to its market price.

In all other cases, the application is submitted to a special commission.

Step 5. Waiting for the commission's decision

The application will be reviewed within a month from the date of acceptance. After review, the applicant will be notified of the results. In addition, he has the right to attend the meeting of the commission.

The result of the review may be a refusal to reassess or a satisfactory decision. Members of the commission independently notify Rosreestr of the adopted verdict. In case of refusal, the owner can challenge this decision in court within 10 days.

Step 6. Filing a claim in court

Starting in January 2021, citizens and organizations have the right to sue immediately, bypassing a special commission. However, this method is often more expensive, so many people use the old algorithm.

The statement of claim is filed at the location of the defendant (Rosreestr). The document specifies one of the following requirements:

- challenge the decision or actions of the commission;

- establish a cadastral value for real estate, taking into account the identified inaccurate information.

In addition, the claim indicates the name of the court, the plaintiff and the defendant, information about the violation of the rights or legitimate interests of the applicant, the grounds and arguments for confirming the claims, as well as a list of attached documents.

The claim is accompanied by exactly the same documents as when applying to the commission and the administrative decision made. You will need to make notarized copies of the papers for the defendant.

Filing a claim in court is subject to a state fee. For citizens it is 300 rubles, for organizations – 2000 rubles.

Step 7. Court hearing

The court will consider the claim within one to two months, depending on the circumstances of the case. During the review process, the plaintiff must prove the illegality of the previously established cadastral value.

If, as a result of the court hearing, the cadastral value of the property is adjusted, the changes will apply from January 1 of the year in which the claim was filed. That is, the tax office will have to recalculate the property tax.