Inspectors of the State Labor Inspectorate have new regulations for conducting inspections for compliance with labor laws. The administrative regulations came into force on October 22, 2021. There have been no fundamental changes, but many amendments will be beneficial and useful to enterprises.

The regulation was approved by Order of the Ministry of Labor No. 160 dated June 13, 2019, but was registered with the Ministry of Justice only on October 10, 2019.

The regulations are very extensive at 96 pages, but we will consider only the most important points.

Regulatory regulation of scheduled inspections of the labor inspectorate

The legal basis for conducting inspections by the State Labor Inspectorate is contained in the following regulations:

- Convention of the International Labor Organization “On Labor Inspection...” of July 11, 1947 No. 81 (hereinafter referred to as the ILO Convention);

- Chapter 57 of the Labor Code of the Russian Federation (hereinafter referred to as the Labor Code of the Russian Federation);

- Law “On the Protection of Rights...” dated December 26, 2008 No. 294-FZ (hereinafter referred to as Law 294-FZ);

- Regulations on supervision of compliance with labor legislation, approved. Decree of the Government of the Russian Federation dated September 1, 2012 No. 875 (hereinafter referred to as the Regulations);

- Administrative regulations for the performance by the State Labor Inspectorate of the function of supervising compliance with labor legislation, approved. by order of the Ministry of Labor dated October 30, 2012 No. 354n (hereinafter referred to as the Regulations);

- Methodological recommendations for planning GIT in the constituent entities of the Russian Federation of activities to supervise compliance with labor legislation, approved. by order of Rostrud dated October 28, 2010 No. 455 (hereinafter referred to as the Methodological Recommendations).

What does the State Tax Inspectorate check during a routine inspection?

The supervisory activities of the labor inspectorate are aimed at detecting any violations of labor legislation and bringing those responsible for them to justice. For this purpose, the law specifically provides for such a form of supervision as conducting scheduled and unscheduled inspections (Article 356 of the Labor Code of the Russian Federation).

Methodological recommendations (subclause 2.6, clause 2) highlight comprehensive and thematic scheduled inspections of GIT. The subject of the first is compliance with labor legislation in general (for the main institutions of labor law). Thematic audits may relate to a specific aspect of the employment relationship, for example:

- their proper registration;

- wages;

- concluding a collective agreement;

- working time and rest time;

- providing guarantees and compensation;

- provision of personal protective equipment;

- registration and investigation of industrial accidents;

- respect for women's labor rights, etc.

In practice, the plans indicate “compliance with labor and labor protection legislation” as the purpose of the inspection. It is hardly possible to predict in advance what exactly inspectors will be interested in.

The State Tax Inspectorate also has the right to verify compliance with orders to eliminate violations and take measures to prevent them, issued based on the results of previously conducted inspections.

The employer's compliance with the terms of local regulations (LNA), collective and labor agreements is not directly included in the subject of GIT inspections. But the obligation to fulfill them is established in Part 2 of Art. 22 Labor Code of the Russian Federation. Therefore, checks are carried out in this part as well.

Fines based on the results of the inspection

What happens if the labor inspectorate finds violations? First, an order is issued. If the employer does not correct the violations within the required time, a fine is issued or the company's activities are temporarily suspended. Who is obliged to pay it? It all depends on the internal rules of the company. This could be an individual entrepreneur, director, chief accountant.

Let's look at the list of common fines in 2021:

- Violation of the Labor Code of the Russian Federation: 1,000-5,000 rubles for legal entities.

- Repeated offense: 50,000-100,000 for legal entities, 5,000-10,000 rubles for individual entrepreneurs.

- Admission to work for a worker without a health certificate: 10,000-20,000 rubles.

- Absence of an employment contract or its incorrect completion: 50,000-100,000 rubles for legal entities and 5,000-10,000 rubles for individual entrepreneurs.

- Repeated evasion of registration of TD: 30,000-40,000 rubles for individual entrepreneurs and 100,000-200,000 rubles for legal entities. For officials, this threatens to close the company for up to 3 years.

- Violation of labor safety standards: 2,000-5,000 rubles for individual entrepreneurs and 50,000-80,000 rubles for legal entities.

- Repeated similar offense: 30,000-40,000 rubles or closure for up to 3 years for individual entrepreneurs and 100,000-200,000 rubles or closure for up to 3 months for legal entities.

The more responsibility a manager or authorized person bears from the point of view of the law, the greater the fine he is subject to.

How to find out when there will be a scheduled GIT inspection in 2020?

How to find out when the labor inspectorate will check? You can do this in 2 ways:

- Firstly, labor inspectorates in the constituent entities of the Russian Federation are required to publish plans on the official website on the Internet (Part 5, Article 9 of Law 294-FZ). Typically the plan is posted as an Excel file. Among other information, the month the inspection began is indicated. The placement period is until December 1 of the year preceding the year of inspection (clause 40 of the Regulations).

- Secondly, before December 31 of each year, information about inspections for the next year is included in a single consolidated plan for inspections of business entities (Part 7, Article 9 of Law 294-FZ).

On the website of the Prosecutor General's Office of the Russian Federation there is a service that allows you to find out whether there are inspections planned for an enterprise (and not only from the State Tax Inspectorate). To do this, it is enough to enter at least the TIN of the organization or entrepreneur. The result will show:

- inspection bodies;

- subject of inspection;

- month the inspection began;

- period of verification activities.

It is impossible to know the specific start date of the inspection in advance. However, according to Part 12 of Art. 9 of Law 294-FZ, the enterprise is notified of the start of control measures no later than 3 working days before the start by sending a copy of the relevant order.

Check results

Based on the results of the GIT inspection, a report is drawn up in 2 copies (for the GIT and for the organization being inspected). The form of the act was approved by the Ministry of Economic Development. The report is drawn up immediately after the end of the event, but the inspector has the right to issue this report within a maximum of 3 working days. If violations are identified, an order to eliminate them is attached to the report, indicating the deadline for execution. In cases where the violations are serious or the deadlines for fulfilling the issued order are violated, the GIT inspector draws up a protocol on the administrative violation and a resolution imposing an administrative penalty in the form of a fine. The employer has the right to immediately find out the results of the labor inspection, after which he has 15 days to submit his objections to a higher official of the State Labor Inspectorate or 10 days to appeal in court.

Frequency of planned control by labor inspectorate

Previously, GIT inspections were carried out no more often than once every 3 years. Since February 2021, a risk-based approach has been applied to labor supervision (clause 17 of the Regulations). Inspection plans for 2021 were developed taking this approach into account.

The essence of the approach is that all organizations and entrepreneurs are assigned a certain risk category. The procedure for its assignment is regulated by the Rules, approved. Decree of the Government of the Russian Federation dated August 17, 2016 No. 806. Depending on the risk category, the frequency of inspections is established:

- high - once every 2 years;

- significant - once every 3 years;

- average - once every 5 years;

- moderate - once every 6 years.

IMPORTANT! Scheduled inspections of low-risk enterprises are not carried out. If a risk category has not been assigned, the enterprise is considered to have low risk.

Information about companies with the first two risk categories is published on the official website of the Federal Service for Labor and Employment. In addition, any enterprise can find out its risk category by written request to the State Labor Inspectorate. The response is sent within 15 working days from the date of receipt of the request. It is possible to submit an application to change the risk category.

For enterprises operating in the fields of healthcare, electricity, education and some others, special inspection periods are established, regardless of the risk category (see Part 9, Article 26.1 of Law 294-FZ; List approved by Decree of the Government of the Russian Federation dated November 23. 2009 No. 944). They can be checked even more often than once every 2 years.

Principles for forming a GIT inspection plan

An exhaustive list of grounds for conducting scheduled inspections by the labor inspectorate is established in Part 8 of Art. 9 of Law 294-FZ. They are the expiration of the above deadlines from the date:

- Registration of an organization or entrepreneur.

- The end of the previous scheduled inspection.

- The enterprise begins to conduct certain types of business activities.

In the event of unfounded inspections, the following consequences simultaneously occur:

- their results are invalid;

- guilty officials are subject to administrative liability under Art. 19.6.1 Code of Administrative Offenses of the Russian Federation.

Let us note that the presence of grounds for a scheduled inspection does not mean that the company will certainly be included in the plan. And if it is not included in the approved plan, then its inclusion there in the future is not allowed. The exhaustive grounds for adjusting the plan are contained in clause 41 of the Regulations. They only concern exclusions from the plan and changes in information about those being audited.

Powers of inspectors during inspections

The rights of state labor inspectors are enshrined in Art. 357 Labor Code of the Russian Federation. So, as part of the check they can:

- at any time of the day, freely visit the territory of any employers (including individuals);

- request documents, explanations and other information from employers;

- select samples of processed and used substances and materials for analysis, etc.

In addition, on the basis of Art. 12 of the ILO Convention, GIT inspectors can ask questions directly to the enterprise personnel.

At the same time, inspectors must strictly comply with the requirements of the law (Article 358 of the Labor Code of the Russian Federation). The employer needs to examine what responsibilities and limitations are imposed on inspectors. In case of violations, their actions should be appealed. Thus, inspectors can enter the employer’s territory only upon presentation of their official identification and an inspection order (clause 47 of the Regulations).

Restrictions for inspectors are set in Art. 15 of Law 294-FZ. For example, it is prohibited:

- carry out an inspection in the absence of the head of the enterprise, entrepreneur, other official or their authorized representatives;

- request information not related to the subject of the inspection;

- disseminate information obtained during the inspection that constitutes a secret protected by law;

- offer to pay for control activities;

- require information before the inspection begins, etc.

Unreasonably obstructing inspectors or evading an inspection threatens the employer with fines under Part 1 of Art. 19.4 and/or art. 19.7 Code of Administrative Offenses of the Russian Federation.

Limits of unscheduled control of Rostrud

Law 294-FZ makes a reservation that verification based on the expiration of a previously issued order is limited only to confirmation of its implementation (Part 21, Article 10). However, according to the general norm of the same law, regulatory authorities are generally prohibited from going beyond the scope of the inspection (clause 3 of Article 15).

Therefore, the boundaries of an unscheduled inspection by the labor inspectorate directly depend on the basis for its conduct. Thus, in response to a complaint about non-payment of wages, the inspectorate must check the employee’s arguments and request only documents that will help to do this.

The list of documents required as part of an unscheduled inspection may differ from those indicated above. So, if it is carried out following an industrial accident, the State Inspectorate may request:

- information about the work carried out on the territory of the enterprise, civil contracts on the basis of which such work is carried out, details of contractors;

- data on the state of injuries at the enterprise;

- accident investigation acts, etc.

IMPORTANT! You can complain about certain unlawful actions of the State Tax Inspectorate (including when requesting “extra” documents) in the manner prescribed by Section V of the Regulations.

The law does not contain a list of documents that Rostrud has the right to require (for both types of inspections). The main thing is that the prohibition on requesting documents (as well as other information, samples, specimens, etc.) not related to the subject of inspection is not violated. And the decision on the relevance of certain objects to its subject is subjective and is made by the state labor inspector.

What documents may the State Tax Inspectorate require?

Representatives of the labor inspectorate have the right to demand from the employer any documents related to the subject of the inspection. Among them:

- Charter of the organization, certificates of registration and registration with the tax office, regulations on the branch, etc.

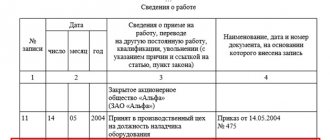

- Personnel documents: labor and collective agreements, work books, orders, staffing tables, time sheets, etc.

- Local regulations: on wages, on personal data, business trips, internal labor regulations, on labor protection, etc.

- Accounting documents relating to the calculation and payment of wages: pay slips, personal accounts, pay slips, etc.

- Logs of safety briefings, accident records, etc.

IMPORTANT! Inspectors do not have the right to request information that they can receive as part of interdepartmental interaction: information from the Unified State Register of Legal Entities, Unified State Register of Individual Entrepreneurs, Unified State Register of Entities, data on the status of settlements for insurance premiums, etc. (clause 8 of Article 15 of Law No. 294-FZ, p. 51.1 of the Regulations).

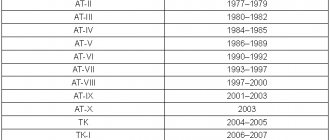

The law does not establish restrictions on the period for which the inspection is carried out. However, it is possible that the storage period for the documents has expired and they have been destroyed. Then the employer may not provide these documents by sending written explanations about the reasons for their absence. Please note that the storage periods for personnel documents and other documents related to labor relations are established in the list approved. by order of Rosarkhiv dated December 20, 2019 No. 236. For details, see here.

Results

Planned control activities of the State Labor Inspectorate are aimed at identifying and suppressing violations of labor legislation and bringing those responsible to justice. The audit can be devoted to both general institutions of labor law and specific ones. It is impossible to know in advance which documents the supervisory authority will be interested in. The employer is recommended to review the inspection plan annually to meet inspectors fully prepared.

Sources:

- Labor Code of the Russian Federation

- Law “On the Protection of Rights...” dated December 26, 2008 No. 294-FZ

- order of Rosarkhiv dated December 20, 2019 N 236

- Code of Administrative Offenses

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Verification of an employee’s complaint: general provisions, types, deadlines

Both current and dismissed employees can complain to the State Tax Inspectorate.

The inspectors will be informed about who exactly filed the complaint only if the employee has not expressed a desire to hide his identity (Part 2 of Article 357 of the Labor Code of the Russian Federation). The powers of the labor inspectorate when checking an employee’s complaint do not imply the possibility of its termination due to the withdrawal of the complaint. Elimination of violations by the employer may be taken into account when imposing an administrative penalty.

Upon receipt of a complaint, the State Tax Inspectorate has the right to carry out unscheduled control measures against the employer in the form of a documentary or on-site inspection. The form of control depends on whether it is possible to objectively assess the employer’s actions only from documents or whether it is necessary to visit the enterprise (Clause 2, Part 3, Article 12 of the Law “On the Protection of Rights...” dated December 26, 2008 No. 294-FZ, hereinafter referred to as Law 294 -FZ).

IMPORTANT! Conducting an immediate on-site inspection is acceptable. But if the State Tax Inspectorate had the opportunity to assess the employer’s activities based on documents, there is a chance of successfully appealing the results of such an audit in court (see the decision of the Leninsky District Court of Perm dated November 2, 2011 in case No. 2-3664/2011).

To begin an inspection in any form, an order to conduct it is required. By virtue of Part 9 of Art. 360 of the Labor Code of the Russian Federation, the employer is not notified of an inspection based on an employee’s complaint.

Any unscheduled GIT inspection lasts no more than 20 working days. This period will not be extended. But the number of such inspections per year is not limited.

The procedure for conducting an unscheduled inspection by the state labor inspectorate was explained by V.I. Neklyudov, a labor inspector for the Nizhny Novgorod region. Read the opinion of the official in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.