Situations when FSPP employees have the authority to withhold funds from a bank card

If the defaulter is recognized as a debtor on the basis of a court order, the claimant has the right to apply with a writ of execution to the FSPP. Service employees will be able to forcibly collect the debt.

Notification of the opening of legal proceedings must be sent to the debtor so that he can repay all debt obligations on a voluntary basis.

The procedure for forced debt collection implies the following:

- Seizure of funds from the debtor's accounts, write-off of money and redirection to the account of the creditor.

- Confiscation of property, its sale to pay off debt.

- Imposing restrictions on travel outside the Russian Federation.

In addition, the defaulter will be charged an enforcement fee.

Types of debt obligations that bailiffs most often collect:

- For credit loans.

- Taxes and fees.

- Compensation for damage caused to health or life.

- Fines.

- Communal payments.

Expert opinion

Evgeniy Sergeevich Makarov

Arbitration manager with more than 10 years of experience

Almost any debt can be enforced. At the same time, there are cases when the applicant may not even contact the bailiff service. For example, collection of fines, penalties, alimony.

In order to seize funds from a debtor’s card, you do not need to ask for his consent.

What payments do bailiffs have the right to withhold?

50% of my salary is withheld according to the writ of execution. I'm going on maternity leave in July. What payments do bailiffs have the right to withhold (maternity pay, child care benefits up to 1.5 years)?

Article 101 of the Federal Law of the Russian Federation No. 229-FZ “On Enforcement Proceedings” defines the types of income that cannot be levied:

1. Collection CANNOT BE APPLIED to the following types of income:

1) sums of money paid in compensation for harm caused to health; (child support is withheld)

2) sums of money paid in compensation for damage in connection with the death of the breadwinner;

3) sums of money paid to persons who received injuries (wounds, injuries, concussions) in the performance of their official duties, and members of their families in the event of the death of these persons;

4) compensation payments from the federal budget, budgets of constituent entities of the Russian Federation and local budgets to citizens affected by radiation or man-made disasters; (child support is withheld)

5) compensation payments from the federal budget, budgets of constituent entities of the Russian Federation and local budgets to citizens in connection with caring for disabled citizens;

6) monthly cash payments and (or) annual cash payments accrued in accordance with the legislation of the Russian Federation to certain categories of citizens (compensation for travel, purchase of medicines, etc.);

7) amounts of money paid as alimony, as well as amounts paid for the maintenance of minor children during the search for their parents;

compensation payments established by the labor legislation of the Russian Federation:

compensation payments established by the labor legislation of the Russian Federation:

a) in connection with a business trip, transfer, employment or assignment to work in another location;

b) due to wear and tear of a tool belonging to the employee;

c) sums of money paid by the organization in connection with the birth of a child, the death of relatives, and the registration of marriage;

9) insurance coverage for compulsory social insurance, with the exception of old-age pensions, disability pensions and temporary disability benefits;

10) pensions in case of loss of a breadwinner, paid from the federal budget;

11) payments to pensions in the event of the loss of a breadwinner from the budgets of the constituent entities of the Russian Federation;

12) benefits to citizens with children, paid from the federal budget, state extra-budgetary funds, budgets of constituent entities of the Russian Federation and local budgets;

13) funds of maternity (family) capital provided for by Federal Law of December 29, 2006 N 256-FZ “On additional measures of state support for families with children”;

14) the amount of one-time financial assistance paid from the federal budget, budgets of constituent entities of the Russian Federation and local budgets, extra-budgetary funds, from funds of foreign states, Russian, foreign and interstate organizations, and other sources:

a) in connection with a natural disaster or other emergency circumstances;

b) in connection with a terrorist act;

c) in connection with the death of a family member;

d) in the form of humanitarian aid;

e) for providing assistance in identifying, preventing, suppressing and solving terrorist acts and other crimes;

15) the amount of full or partial compensation for the cost of vouchers, with the exception of tourist ones, paid by employers to their employees and (or) members of their families, disabled people not working in this organization, to sanatorium-resort and health-improving institutions located on the territory of the Russian Federation, as well as amounts full or partial compensation of the cost of vouchers for children under the age of sixteen to sanatorium-resort and health-improving institutions located on the territory of the Russian Federation;

16) the amount of compensation for the cost of travel to the place of treatment and back (including the accompanying person), if such compensation is provided for by federal law;

17) social benefit for funeral.

2. For alimony obligations in relation to minor children, as well as for obligations for compensation for damage in connection with the death of the breadwinner, the restrictions on foreclosure established by paragraphs 1 and 4 of part 1 of this article do not apply.

This is important to know: Act of execution: sample

How much can they withdraw?

The amount of funds subject to seizure is indicated in the court order. In addition to this amount, the bailiff also has the right to withdraw the enforcement fee. The rest of the amount must remain untouched. However, if there is not enough money, each receipt will be written off. According to the law, more than 50 percent of the funds cannot be withheld from the debtor, since he needs to live on something. But there are situations when the amount can reach 70 percent:

- Alimony payments.

- Compensation for harm caused to health or life.

- Damage caused during the commission of a crime.

At the request of the defendant, the amount to be withheld may be reduced if he has a dependent minor child.

Algorithm and conditions for withholding funds from the debtor’s card

Seizing money from an account is a legal procedure. It is carried out on the basis of a court decision.

The following have the authority to claim money:

- An ordinary citizen.

- Entity.

- Tax Inspectorate.

Forcible collection of debts is possible only in the following cases:

- A person refuses to voluntarily pay debts.

- The creditor's demands are legal.

- The debt arose due to the fault of the debtor.

Relationship between the bailiff service and banks

Cards are subject to blocking based on the FSPP resolution. However, if the bailiff receives a message that the plastic card is a salary payment, the account must be unblocked. Based on this notification, the bailiffs send a notice to seize the bank account. If there is not enough money, then the write-off will continue until the debt is fully repaid. We conclude that service employees have the authority to block absolutely any person’s account.

What money cannot be withheld from a defaulter’s card:

- Maternity capital funds.

- Child benefits, alimony payments.

- Compensation for the loss of a breadwinner.

- Payments to victims of the consequences of radiation and man-made disasters.

- Payments to government employees injured while on duty.

Restrictions

According to paragraph 2 of Article 99 No. 229-FZ, more than 50% of the salary and other profits cannot be recovered from the defaulter.

Amounts will be collected from wages until the debt is paid in full.

The following amounts are collected without limitation:

- Child support;

- Compensation for the following types of damage:

- Health.

- For the loss of a breadwinner.

- In connection with a crime.

The percentage in the described cases is no more than 70.

Cannot be held with:

- payments for compensation for harm to the debtor's health;

- the amount of compensation for the loss of a breadwinner (in relation to the defaulter);

- payments to citizens who were injured, etc. while performing their official duty;

- compensation to citizens affected by radiation or man-made accidents;

- compensation to citizens for caring for disabled persons;

- cash reimbursements for travel, purchase of medicines, etc.;

- alimony amounts;

- travel expenses;

- financial assistance in connection with birth, death, marriage registration;

- insurance payments for compulsory social insurance (this does not include old-age and disability pensions and certificates of incapacity for work);

- social pensions according to the SPC;

- payments to social pensions under the SPC;

- social benefits for citizens with children;

- M(S)K funds, according to the standards of the Federal Law of December 29, 2006 No. 256-FZ;

- one-time financial payments.

- amounts of compensation for sanatorium treatment, children's vouchers;

- funeral benefit.

Situations of seizure of funds from a salary card

Blocking of salary cards is carried out in case of debt formation to the state, financial institutions or ordinary citizens. Tax debts additionally imply the accrual of fines and penalties.

The tax office has the authority to block the debtor's account until the debt is completely paid off. But this does not apply to ordinary citizens; such measures apply exclusively to legal entities and individual entrepreneurs. An account can only be blocked if there is a corresponding resolution.

Bailiffs can deduct money from a salary card:

- To pay off utility bills.

- To transfer alimony.

- To pay a court penalty.

- To pay administrative fines.

Blocking and writing off funds

Seizure of a bank account is considered a legal procedure and implies the following actions:

- The applicant submits a statement of claim with accompanying documentation to the court. If the evidence is weighty, then the claims are subject to certification.

- The debtor is offered to independently close debt obligations within the allotted time period. If he does not want to pay, then the writ of execution is transferred to the FSPP for forced collection of the debt.

- Service employees submit requests to financial organizations to locate the debtor's accounts with them. Banks are required to provide such information.

- The bailiffs require the credit institution to block the defaulter's card and transfer funds in favor of the creditor.

Note! Seizure of a card means a complete ban on transactions with it. It is impossible to withdraw money and transfer it here. Only after paying off the debt will a citizen be able to begin to use it fully.

Allowable retention percentage

It is not allowed to completely block the payroll of a defaulter. Especially if it is the only source of income.

Legislative acts allow withholding from the defaulter’s account no more than 50 percent of the total amount. Initially, all funds may be withheld, but subsequent collections should not exceed 50 percent.

However, there are situations when it is allowed to withhold up to 70 percent of the total accrual amount:

- Alimony payments for the maintenance of their common minor children.

- Compensation for harm caused to the life or health of a person.

- Actions that resulted in the disability or death of the sole breadwinner.

- Hiding arrears as a result of theft.

Note! If the plastic belongs to one parent, then the bailiffs cannot withhold more than 25 percent of the funds from her. If a family has several minor children, then it is prohibited to seize more than 30 percent of the total amount.

Limit amount of salary deductions in 2021

The norms of the Labor Code of the Russian Federation contain restrictions on the amounts that the employer has the right to withhold from the employee’s salary.

According to Art. 138 of the Labor Code of the Russian Federation, the total amount of deductions from an employee’s salary cannot exceed:

- 20% – in the general case;

- 50% – in cases provided for by federal laws;

- 70% – in special cases.

Strictly speaking, if the employee does not have other grounds for deduction (for example, writs of execution), the employer has the right to withhold from the employee’s salary no more than 20% of the accrued salary.

If writs of execution are received in the name of an employee, on the basis of which the employer is obliged to withhold alimony, compensation for material damage, loan repayment, utility debts, etc., then the total amount of deductions should not exceed 50% of the amount of accrued wages ( including personal income tax).

In exceptional cases, the employer has the right to withhold up to 70% of the employee’s income. We are talking about the following grounds for retention:

- payment of alimony to minor children;

- compensation for damage caused by an employee in connection with the death of the breadwinner;

- compensation for damage (including harm to health) caused in connection with a crime committed by an employee.

The basis for the above deductions is a writ of execution issued on the basis of a relevant court decision.

The card is blocked. Procedure

As a rule, accounts of large banking institutions are quickly seized. After all, the bailiffs make requests there first. If the defaulter has an account opened in a small branch of a little-known financial institution, then the deduction will occur a little later.

In case of deduction of wages from a bank card, experts advise following the following instructions:

- Go to the credit institution and request a statement confirming that wages are actually being transferred to the card. Then you need to write an application to the bailiff service about partial withdrawal of money from the card. Then the debt will be repaid in equal parts, but no more than half of the funds will be withdrawn from the plastic.

- You can also agree with your employer that for some time your wages will be given to you in person, bypassing bank transfers.

- Enter into an agreement with the creditor on deferment or partial repayment of debt obligations. Such measures will help prevent your account from being blocked.

- If the bailiffs nevertheless blocked the card, which is the only source of income, then their actions can be appealed to a judicial institution.

Expert opinion

Makarov Evgeniy Sergeevich

Arbitration manager with more than 10 years of experience

The ideal option here would be to fully repay the debt to creditors. In this case, the bailiffs will immediately transmit information to the bank about unblocking the account.

Debtor's appeal to a credit institution

Before lifting an arrest, a person must seriously prepare. You must first find out the number of the enforcement proceedings from the bank, and also obtain a statement of your bank account. If, in addition to salary, he receives other funds that do not exceed half of the salary, then there is a possibility that no more than 50 percent will be withheld.

Preparation of documents

To confirm that the bank account is indeed a salary account, the defaulter must obtain the following documents from his employer:

- A copy of the work book.

- Extract from the accounting statement of the enterprise.

These papers are sent to the bailiff service to remove the blocking. FSPP employees, in turn, send a notification to the company where the defaulter works to remove the arrears from his salary.

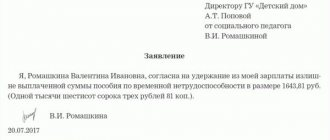

Sample statement of the debtor's salary account

This document does not have a strict form. You can write it in a free version, but adhering to a business style.

Basic information:

- Postal address and details of the branch of the regional service of the FSPP.

- Full personal information about the applicant, residential address and contact details.

- Document's name.

- The essence of the appeal, the number of the writ of execution, the date of preparation, the order number.

All of the above will help to avoid the seizure of the card; they will only charge a certain percentage from it to pay off the debt.

A sample certificate of employment is available

Petition to reduce the withholding percentage

This application is submitted together with the writ of execution to the banking institution. FSPP employees do not have information about what kind of account this is, and also do not know what money is stored in it.

A sample about reducing deductions you can

Unblocking

There are cases when the card seizure is cancelled. For example, if the debtor is a single parent, or the family has several minor children. To confirm these statuses, a person must provide relevant documents.

Additionally, you can send an application to the bailiff service. It must reflect the following information:

- Name of the organ.

- Full information about the bailiff, address of the FSPP branch.

- Date of opening of enforcement proceedings, sheet number.

- Order number.

- Name of the credit institution, blocked account number.

The period for consideration of the application is thirty days.

Blocking without notification

According to the law of the Russian Federation, banking institutions are not required to notify citizens about account blocking. But this information can be obtained via SMS message or in the online banking application.

Order to cancel the arrest

If a positive response comes from the bailiff service, then the account should be unblocked. As a rule, arrest is lifted through internal electronic document management. However, there are cases where database failures have occurred. To have the arrest lifted faster, you need to go to the FSPP branch, take an order to cancel the arrest and go with it to the bank.

Period of revocation of arrest

After submitting the order to the credit institution, it is given seven days to unblock the account.

After the debtor has closed the debt obligations, you need to obtain a certificate from the creditor confirming that there are no claims for payments. This document must be brought to the FSPP; it will serve as an additional argument for lifting the arrest.

If funds are written off in full

Situations often arise when a person’s entire salary is written off. In this case, you need to take a certificate from your place of work about the amount of your salary and the method of receiving it. You need to come with it to the bailiff service office and write an application to reduce deductions.

There are cases when it is not possible to solve a problem through peaceful means, then you have to act through the courts. For example, if you need to reduce deductions by less than 50 percent.

You can also agree with the lender on an individual debt repayment schedule. Then he will be able to take away the writ of execution, and the bailiffs will no longer withhold money from wages.

Erroneous deduction of money from the card

Unfortunately, errors in the activities of FSPP employees are being identified more and more often. Often, money can be written off by mistake, for example, if you happen to be the namesake of the defaulter. If the money is written off by mistake, you need to fill out an application to the FSPP. And then proceed according to the instructions:

- Make a request for documents from a banking institution. Bank employees are required to provide all information about the bailiff, the number of the writ of execution, etc.

- Submit a petition to the bailiff about the erroneous withdrawal of funds. Attach evidence confirming the illegality of the write-off.

- Contact the court. If the bailiff ignores your demands, then you can seek the truth by contacting the senior bailiff, or directly in court.

Types of mandatory deductions from wages

The entire set of deductions made from an employee’s salary can be divided into three categories:

- Mandatory - carried out in accordance with the rules prescribed by law. These amounts must be withheld regardless of the will of the employer or employee.

- Voluntary - carried out on the initiative of the employee himself (for this he must submit a corresponding application).

- At the employer’s initiative, the company’s management has the right to make such deductions in the following cases: the employee was previously accrued erroneous amounts, an advance remained unpaid, the employee caused material damage to the company, etc.

Personal income tax

This type of deduction belongs to the category of mandatory. In accordance with Ch. 23 of the Tax Code of the Russian Federation, every individual must pay personal income tax on their income. In this case, the employer plays the role of a tax agent. His task is to withhold the due amount of tax from the employee’s salary and direct it to the state budget.

Retention of loans under writ of execution

This type of withholding occurs when the debtor defaulted on the loan, the bank went to court, after which a decision was made to collect the debt.

Subsequently, the writ of execution issued to the claimant is presented at the debtor’s place of work. Based on this document, the latter’s salary is reduced monthly by a set payment, which is sent to the bank (to repay the overdue loan).

Withholding of alimony by agreement

Family law allows parents of a minor child to enter into an agreement between themselves on the payment of child support for their common child.

If for some reason the payer violates the agreement reached, then the other party can forcibly collect the amount specified in the text of the agreement. To do this, you need to contact the bailiffs or transfer this document to the debtor’s employer.

REFERENCE. An agreement to pay alimony has the force of a writ of execution, so it is not at all necessary to go to court to enforce the collection of these payments. The debtor should remember this important feature.

Withholding of alimony under a writ of execution

If the parents were unable to agree on the financial support of the child peacefully, then they can resolve this issue in court.

The judicial authority makes a decision determining the amount and frequency of payments. After this, the recipient of the funds can withdraw the writ of execution and begin the collection process. This can also be done through bailiffs or by contacting the debtor’s employer (according to the writ of execution, he will have to make monthly deductions from his employee’s wages).

If the account is not unblocked

If a decision has been made on forced collection of debts, then the debtor in any case is given five days to voluntarily return the funds. If a person did not receive a copy of the resolution, but the arrest occurred, then these actions of the bailiffs are a violation. To solve the problem, he needs to contact the regional branch of the FSPP.

Algorithm of actions:

- The person will receive an order to begin enforcement proceedings and possible criminal liability, but the blocking must be lifted.

- If the debt is not repaid within five days, the bailiff has the right to re-block the card with the money completely written off.

- In addition to writing off the principal amount of the debt, an enforcement fee (7 percent) may also be withheld.

It’s better not to make mistakes with alimony

When making deductions based on writs of execution, it is better not to make mistakes. Administrative liability is provided for incorrect withholding. In addition, if during the inspection the bailiff discovers that the incorrect withholding of alimony was carried out intentionally, he will contact the prosecutor's office so that the officials of the organization are brought to criminal liability (for more information, see “Responsibility is provided for the incorrect withholding of alimony”).

This is important to know: Time limit for the production and issuance of a writ of execution by the arbitration court under the Arbitration Procedure Code of the Russian Federation

If you find an error, please select a piece of text and press Ctrl+Enter.