How to register a salary for a part-time rate in documents

Staffing table

The staffing table is a planning document and may or may not provide for the size of official salaries and other columns. This depends on the form used - unified T-3 or approved by the organization.

Typically, the staffing table indicates the amount that the employee receives for performing job duties based on the number of staff units and their occupancy.

| Example |

| If full-time employment is 40 hours, this is 1 full-time position. |

| If not full, it could be 0.2 or 0.5 staff units. And so on. |

How to fill out a bid

You can fill it out as follows.

- Provide employment for the main employee during maternity leave. The end date is not indicated; instead, the interval for which it is issued is indicated: for the period of waiting for the child and childbirth, caring for the baby until he turns 1.5, 3 years old.

- Perform a temporary transfer of an employee working in the organization until the maternity leaver returns to work. According to Art. 72.2 of the Labor Code of the Russian Federation, transfer to a maternity rate is permissible with the consent of the contracting parties, drawn up in writing. Based on the agreement, a transfer order is prepared. They do not enter the labor record.

It is possible to transfer a worker from one maternity rate to another only within the time interval for the first position. After the transfer is completed, the transferred person is given the previous position, otherwise the fixed-term employment contract is recognized as concluded permanently. If the term for a new job goes beyond the term for the first place, then the solution to the problem will be transfer through dismissal to a maternity rate. The employee must resign of his own free will or by agreement of the parties and re-enter under new conditions.

- Distribute absentee responsibilities among employees. The combination is formalized: an additional agreement is concluded, on the basis of which the personnel service prepares an order. There is no need to make a note in the work book.

Employment contract

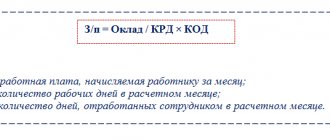

The law does not say how to indicate the salary for a part-time job in an employment contract. In accordance with Article 93 of the Labor Code of the Russian Federation, when working part-time, the employee’s payment must be made in proportion to the time he worked.

Example. If the employment contract or hiring order states that the employee is hired at 0.5 times the rate, then it is logical that the employee should receive an amount less than that indicated in the staffing table for 1 whole rate.

The employment contract should indicate the amount of the official salary, indicating the employment and indicating that payment is made in proportion to the time worked. That is, the employment contract should indicate the full salary that the employee receives while occupying an entire staff position.

| An example of a salary entry in an employment contract when hiring a part-time employee |

| The Employer sets the Employee a salary in the amount of ______________ rubles for a fully worked calendar month. The employee is remunerated in proportion to the time worked based on a 20-hour working time. |

Indicate the official salary that the employee will receive for a fully worked calendar month based on a 40-hour work week. Next, write down that since the employee is assigned part-time work, payment is made in proportion to the time worked, based on a 20-hour work week. That is, in fact, the employee will receive less than the established official salary when working full time.

Legislative meaning of maternity rate

The maternity rate is active only during the period of maternity absence of an employee who is the main employee for the employer. Therefore, for the duration of the maternity leave, a fixed-term employment contract is concluded with the potential deputy. A clear end date is not indicated, but is strictly tied to maternity absence. Termination of the agreement occurs upon the completion of one or two events at once at the request of the main employee.

Maternity leave cannot be shortened, but the number of days in it is extended in case of complications during childbirth. Parental leave, on the contrary, is curtailed in accordance with the wishes of the maternity leave. In fact, the main employee can leave it at any time, without even notifying the employer ahead of time. On the same day, personnel are obliged to dismiss the replacement employee due to the expiration of the contract. At the request of the management, the specialist can be left in the company, transferred to another vacant position with his consent.

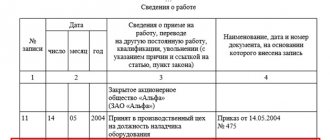

The order of acceptance to work

The employment order must comply with the terms of the concluded employment contract. Reason: Article 68 of the Labor Code of the Russian Federation.

What needs to be indicated in the order:

- The salary amount established for this position by the staffing table.

- The fact that the employee is hired on a part-time basis.

If everything is stated correctly in the order, the employee will receive a lower salary for part-time work. All conditions must comply with the employment contract with the employee.

Maternity leave from maternity place

When accepting a woman of reproductive age to take the place of a maternity leaver, we cannot exclude the possibility that she will also want to soon become a mother. The employer's options differ in the duration of the employment contract:

- If at the time of expiration of the contract the employee does not have a sick leave certificate (for the prenatal and postpartum parts), the employer has the right to dismiss her if there are no vacancies suitable for a pregnant woman on the company’s staff.

- During the prenatal and postnatal parts of the leave, dismissal of an employee is not permissible, even if the employment contract expired during the period of sick leave. All payments from the Social Insurance Fund in this case “fall” on the shoulders of the employer. The employee is also entitled to all maternity benefits determined by the company’s Collective Agreement.

- If at the time the certificate of incapacity for work expires, the contract has not expired, then the replacement employee who gave birth has an excellent opportunity to go on paid maternity leave. It will last until the day the main employee’s maternity leave ends.

An employer has the right not to grant an employee on maternity leave to care for a child up to 3 years old. Many lawyers notice that Article 261 of the Labor Code allows the agreement to be terminated from the date of birth. Therefore, in paragraph 27 of the resolution, the Supreme Court dated January 28, 2014 No. 1 clarified the situation - in the event of the birth of a child, the agreement is extended until the date of closure of the certificate of incapacity for work. In other situations, when the birth of the baby did not take place, the employer has the right to dismiss the employee within a week from the moment he learned about it.

When choosing whether to work on maternity leave, a potential candidate should consider all the advantages and disadvantages associated with the upcoming employment. Of course, there are advantages to such work, but it is optimal to accept a maternity position for those people who do not expect long-term cooperation with the employer, but are confident in their qualifications and competencies. Under favorable circumstances, good people have a chance to get a permanent position in the company, and a temporary position will provide valuable experience and, probably, good benefits.

What is the wage rate

The tariff rate is a documented amount of remuneration for achieving a labor standard or other degree of difficulty per unit of time. The basic principle of applying tariff rates is to pay the same remuneration for the same amount of work.

The tariff rate is necessarily fixed in the employment contract, which is signed with employees. The employee will not receive less than the amount specified in the contract, provided that all job functions are performed.

According to Art. 143 of the Labor Code, the tariff system of remuneration involves a certain differentiation of rates depending on the categories assigned to employees. The wage differentiation consists of:

- From tariff rates (the amount that is paid to employees for fulfilling labor standards, depending on their qualifications and the complexity of the tasks performed).

- From tariff schedules (a system consisting of tariff rates and including the ratio of the complexity of the work performed and the level of his salary).

- From the coefficients.

- From salaries.

To determine the tariff rate, you need to multiply the rate for the first category by the increasing tariff coefficient.

The tariff rate as a unit for calculating earnings performs several important functions: it makes payment and labor content commensurate, denotes a minimum depending on quantitative and qualitative characteristics, stimulates work in given conditions (during processing, hazardous work, etc.), adequately calculates wages .

The time period for which the tariff rate is determined can be any: hour, day or month. Hourly rates are usually set if the company has a shift work schedule or if the company employs hourly employees.

The hourly tariff rate is used in the process of calculating pay on weekends, night shifts, in excess of standards, in dangerous, harmful and difficult conditions.

The hourly rate can be determined in several ways : by dividing the monthly rate by the number of working hours according to the calendar. In the second method, the hourly rate is calculated by dividing the salary by the average monthly number of hours during the calendar year. The exact calculation algorithm used by the employer must be recorded in a local regulatory act (for example, in a collective agreement).

For work at night (from 22 to 6), the employee is paid a salary of no less than 20% more than the standard tariff rate. Work on weekends and holidays is paid at double rate.

Day rates apply if work is completed during the day. At the same time, the number of working hours in a day is the same, but differs from the norm under the Labor Code. That is, it is advisable to use daily rates if the number of working days differs from the standard 5 days.

Monthly rates are valid subject to the process of standardization of working hours : if workers have firm, fixed days off and a stable schedule. In this case, the time sheet must be closed regardless of the number of hours actually worked: after working out the monthly quota, the employee earns a salary.

How many rates can you expect when working part-time?

The need to generate additional income forces working citizens to look for additional places to work.

In this regard, a completely reasonable question arises: how many jobs can one employee officially get? When applying for additional employment, the official status of the employee should be taken into account first of all, since only in this case will he have the rights to all social payments and benefits ( if they are provided for by law for a specific category of working citizens).

Contents: The opportunity, that is, to work in an additional place in the time free from main duties, is provided for by Article 282 of the Labor Code.

A person receives additional work on a permanent basis with a salary established and reflected in the contract. Moreover, additional activities are carried out exclusively in free time (after main work or on weekends, holidays). If you want to know how to solve your particular problem in 2021 , contact us through the online consultant form or call:

We recommend reading: How to drive a car from the USA to Russia