Divorce is an extremely unpleasant event in the life of any person, especially women, because they experience the dissolution of their marriage very acutely. However, despite the overwhelming emotions, you need to gather your strength, since there is a high probability that you will have to go through a difficult divorce process with the division of jointly acquired property and the issue of the fate of the children. If you have a financial opportunity, use the help of a lawyer who will help you calculate the amount of state duty when dividing the property of spouses, file a claim and not lose most of the jointly acquired property through the court.

If there were no appeals to court

Judicial feuds during divorce, especially those related to property disputes, require litigants to waste a lot of time and nerves, which the spouses could save if they turned to a notary and amicably agreed on the division of assets.

What are the advantages of a notarial agreement that formalizes the division of spouses’ assets?

- It is incomparably faster in time than resolving a dispute in court.

- It will cost the husband and wife less than paying court fees and lawyer fees.

- The procedure is much more comfortable than legal feuds, in which ex-spouses often cannot restrain accumulated negative emotions.

How is a notarial agreement concluded? Future parties to the agreement make an appointment with the notary and prepare a package of documents in advance, which includes the following:

- Passports of the parties to the agreement;

- Official papers with which you can verify the existence of ownership of property;

- Purchase and sale agreement or other title documents for real estate;

- The appraiser's conclusion regarding expensive items or items of value that can only be understood by specialists (antiques, collectible weapons);

- Certificate of divorce or marriage.

This last point is very important because there is a myth that after a divorce it is impossible to legally enter into a notarial agreement. This is wrong. Family law allows former spouses to settle property relations within 3 years from the date of annulment.

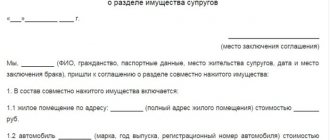

During the meeting, at which, according to legal requirements, only the notary and the parties to the agreement must be present, information about the spouses and their property, as well as the time and place of concluding the agreement, are written into the agreement.

The fees charged by notaries for certifying such agreements are shown in the table below.

| Valuation of property in the agreement, rub. | Notary fee |

| Up to 1000 000 | 0.5%, however, not less than 300 rubles. |

| From 1000001 to 10000 000 | 0.3% of the price, above 1,000,000 rubles, plus 5,000 rubles. |

| Over 10,000,000 | 0.15% of the price, above 10,000,000 rubles, plus 32,000 rubles. |

Also keep in mind that notaries additionally charge money from their clients for so-called “technical and legal services,” which on average cost about four thousand rubles.

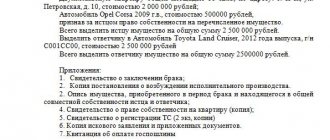

Let's calculate the notary fee for certifying an agreement using a specific example. Let us assume that the contract price is 3,000,000 rubles. What will the tariff be? It is clear that 3,000,000 rubles. included in the range from 1000001 to 10000000 rubles. and will be taken into account 0.3% of the price above 1,000,000 rubles, i.e. We consider 0.3% of 2,000,000 (3 million minus 1 million) rubles. and we get 6000 rubles. To this number we add 5000 rubles.

As a result, the notary fee for this service will be equal to 11,000 rubles.

Who will pay legal costs

According to Article 98 of the Code of Civil Procedure of the Russian Federation, the losing party in the case must reimburse all expenses incurred by the second party. The exception is cases when the court, on its own initiative, ordered an examination, called witnesses and experts to the court (these expenses are paid from the budget of the appropriate level).

Costs are paid in proportion to the portion awarded. For example, if the claim is satisfied in full, the defendant reimburses all expenses; if in parts, then the state duty and other expenses are divided into shares.

As for pre-trial expenses, for example, for paying for the services of an expert in assessing property, they are borne by the party that was interested in this.

The procedure for dividing property in court

Property and claim valuation

How much does it cost to divide property during divorce proceedings? The amount charged as a state fee when dividing property during a divorce depends on the value of the things that are jointly owned by the husband and wife.

Before moving on to directly calculating the amount that needs to be paid for consideration of the claim by a judge, it is necessary to understand what kind of property is subject to division. The Family Code of the Russian Federation clearly states that spouses intending to divorce can only divide jointly acquired property among themselves. What is meant by this concept in legislative acts? These are things, real estate and other property assets and intangible assets acquired by spouses while legally married, namely:

- Income, for example, money or things received through barter, for any type of activity. The only exception is funds issued for a specific purpose.

- Property that was acquired by spouses during marriage using common funds, for example, an apartment.

- Debts on bills and loans.

- Shares in a business acquired during marriage, such as a share in an LLC, as well as ownership of securities, such as bonds or stocks.

At the same time, the legal acts of the Russian state prohibit filing claims for division or otherwise claiming things that are the personal property of a husband or wife, regardless of their quantity. Such property includes:

- Items received as a gift.

- Property that passed to one of the spouses by inheritance.

- Material values and intangible assets that a husband or wife had before they entered into a marital relationship.

Now, having dealt with the question of what property can be divided during a divorce, you need to move on to its assessment. This can be done in two ways:

- Documentedly, for example, using conclusions issued by an insurance company, or official papers provided, for example, by cadastre authorities.

- By seeking help from a professional appraiser. This is a more expensive option, since the specialist will require high payment for his services, but financial expenses can be more than compensated by the fact that his conclusion is usually favorably perceived by the court and has greater authority and weight than the personal assessments of the spouses and other documents.

When determining the price of property, for example, vehicles or household appliances, only the market value is taken into account. Real estate is assessed based on its cadastral value.

Now let's start calculating the state duty when dividing the jointly acquired property of the spouses. It is calculated based on the volume of the total number of assets claimed by the plaintiff. In most cases, they amount to fifty percent of the entire property, only if the plaintiff does not try to challenge the order of transfer of material assets after the dissolution of the marital relationship, which was formalized in the marriage contract. In addition, an unequal division is also possible if the husband and wife previously entered into an appropriate agreement between themselves.

Calculation of state duty depending on the value of the claim

The calculation of the fee that must be paid before filing a claim with the judicial authorities is currently carried out at the rates established by the Tax Code of the Russian Federation and presented in the table below.

| Property price, rub. | State duty for division of property, rub. |

| Up to 20,000 | 4%, however, not less than 400 rubles. |

| From 20001 to 100,000 | 3% plus 800 rub. |

| From 100001 to 200,000 | 2% of the price, above 100,000 rubles, plus 3,200 rubles. |

| From 200001 to 1000,000 | 1% of the price, above 200,000 rubles, plus 5200 rubles. |

| Over 1000 000 | 0.5% of the price, above one million, plus 13,200 rubles, but in total no more than 60,000 rubles. |

For clarity, we give 2 examples. When you calculate the duty yourself, it is advisable to use a calculator to avoid mistakes.

1 example: imagine that a lawsuit is filed in which a married couple is divorcing, and the plaintiff claims things valued at 700,000 rubles. In this situation, how can you accurately calculate the amount required to pay the state fee? We look at the sign: 700,000 rubles. fall in the range from 200,001 to 1,000,000 rubles, which means you need to calculate one percent of five hundred thousand (this difference is obtained if you subtract 200,000 from 700,000) and add 5,200 rubles to the resulting figure. In other words, you must add 5200 to 5000. The result will be 10200 rubles.

Example 2: The value of the share of appraised property that the plaintiff wants to win for himself in divorce proceedings is 5,000,000 rubles. We calculate the duty. We look at the plate and see that 5,000,000 rubles. fall into the range of over 1,000,000 rubles. One million is subtracted from the amount of the claim (5,000,000 minus 1,000&000), and then 0.5% is calculated from the resulting figure - 4,000,000. As a result, we get 20,000 rubles, to which we add 13,200 rubles, and we get 33,200 rubles. This number is less than 60,000 rubles, hence we conclude that the amount of state duty for a claim price of 5,000,000 rubles. equal to 33,200 rub.

State duty for certain shares of property

Spouses can divide material assets not only in court. They have a statutory opportunity to determine in advance what property will be theirs after a divorce and to determine their shares. In this case, the price of the state duty will be fixed and equal to three hundred rubles, since assets that cannot be assessed will be divided.

In addition, keep in mind that divorce and property dispute are two sides of the same divorce process, but, nevertheless, you will not pay a single state fee, but will pay separately for divorce and for division of property.

Algorithm for calculating duties when dividing property

According to the legislation, all actions related to the assessment of property and, accordingly, the calculation of the state duty for its division in court are carried out by the applicant himself. In this regard, the plaintiff has a question whether there is an algorithm or formula for calculating the duty when dividing property.

The comprehensive procedure for calculating the amount of state duty is determined based on the established standards regarding the cost of the claim:

- up to 20 thousand rubles. — 4% of the amount is subject to payment (from 400 rubles minimum);

- from 20,001 to 100 thousand rubles. — 3% of the claim amount + 800 rubles;

- from 100,001 to 200 thousand rubles. — 2% of the amount – above 100 thousand, + 3.2 thousand rubles;

- from 200,001 thousand to 1 million rubles. — 1% of everything that exceeds 200 thousand, with the addition of 5.2 thousand rubles.

For amounts from 1 million rubles. and higher, the state duty is calculated based on the collection of 0.5% of the amount exceeding 1 million, plus a fixed 13.2 thousand rubles.

It is legally established that the maximum amount of state tax cannot exceed 60 thousand rubles.

A concrete example will help you better understand how to calculate the amount of state duty when dividing marital property in 2021.

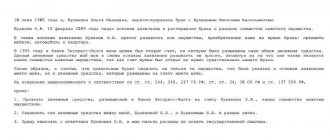

Let's say a spouse filed a lawsuit for the division of property, which consists of a car given to him by the defendant during marriage and an apartment jointly acquired under a mortgage, which was repaid at the time of division. The price of the apartment includes 500,000 rubles. personal funds of the husband's mother and borrowed funds on the loan. The car is personal property and cannot be divided.

This means that the calculator for calculating the state duty in this case looks like this: personal funds are deducted from the cost of the apartment. Since 25% of the share in the apartment already belongs to the husband, the body of the loan is taken into account, amounting to 150 thousand rubles. (or 75%). The claim against the defendant is 75 thousand rubles. (half price). After deducting 200 thousand, 1% of the amount will be equal to 5.5 thousand rubles. To this amount you need to add 5.2 thousand established by law.

So, when dividing an apartment in shares, the state duty will be 10.7 thousand rubles.

How can I pay

Who pays

According to the general rule, in accordance with the norms of the Civil Procedure Code, the state fee for consideration of a claim by judicial authorities must be paid by the plaintiff before filing an application.

Deferment and installment payment

However, if the plaintiff, due to certain circumstances, for example, difficult financial situation, is unable to pay the full cost of the fee, then the court may, by its decision, grant him a deferment or oblige him to pay the state duty in installments. This legislative norm is very relevant for young mothers who are on maternity leave to care for a young child and because of this do not have an independent source of income.

How to achieve a deferred payment?

- You write an application to the court for an installment plan or deferment of payment of the state fee.

- Attach to the application a corresponding document confirming your words that you are currently unable to pay the required amount of money to the state.

- The judge reviews your papers and makes a decision to grant or deny your request.

Where to find out details

You can view the details for payment on the official website of the court to which you plan to apply for protection, and also ask them from the secretary of the court session, to whom you will bring your statement of claim.

What does a sample form look like?

A blank form that needs to be filled out with payment details looks like this:

the form is available at

.

Where can I pay?

Due to the wide variety of methods that can be used to pay state fees, this procedure is unlikely to be very difficult for you. Let's look at the most typical ways in which mandatory government payments are currently usually paid:

- Contact the operator of any bank and provide him with a form with completed details. If you pay state duty through Sberbank, then, as a rule, the operator knows the details of the most popular payments and will process them without any problems. Don't forget to pick up a receipt and check confirming your payment.

- Another convenient option is to pay the mandatory fee through an ATM. Due to the fact that the interface of ATMs at different banks is often noticeably different from each other, it is impossible to give precise recommendations on how to make a payment through a bank terminal. If you need assistance, please contact a bank employee.

- You can pay the fee online. You will need to go to the Internet bank of the banking institution where you are served, find payment of the state duty in the “Payments” tab, enter the appropriate details and transfer the money. After completing the transaction, do not forget to print a check to submit it to the court.

- If you have access to the State Services portal, you can pay the state fee through it.

- Check the website of the court you are interested in. It may be equipped with a service that allows users to make payments for legal services from courts.

Receipt validity period

As for fees paid for legal services of the courts, there are no such strict rules as there are, for example, in relation to fees paid for a driver's license or passport replacement, which are valid for a limited period of time. The fact is that the amount of money that is transferred to the state by the plaintiff in a property division case depends on the assessment of the value of this property. In this regard, the receipt becomes invalid only in one case: if the price of the claim changes. In this case, the plaintiff must take one of two actions:

- Pay the missing part of the funds;

- Demand a refund of overpaid funds.

Is it possible to return payment and how to do it

The state grants you the right to a refund of the money spent in certain cases specified by law, namely:

- You have abandoned your claim in court;

- The court did not accept your statement of claim;

- The court has terminated proceedings on your claim;

- Your claims were left unconsidered by the judicial authority;

- You have overpaid beyond the required amount.

- In the event of your death, your heirs can return the state fee if they refuse to support your claims in court.

To get your money back, you will first need to submit an application, with the help of which you justify the legality of the return of the state duty, to the same court that heard your case. Based on the results of consideration of the application, the judge makes a decision. If it was accepted in your favor, you will need to wait fifteen days until it comes into force.

Next, go with this determination and an application for a refund to the tax office located in the locality of your registration. After submitting documents to the tax office, expect funds to be transferred to your account within a month.

The legislative framework

The legal process on the division of property of spouses and the state fee collected for its implementation, as well as notarial actions that consolidate the agreement on the division of property between spouses, are regulated by the following regulations:

- The Family Code of Russia, which establishes the concept of “jointly acquired property”, establishes the procedure for divorce and division of assets between husband and wife.

- The Tax Code of Russia, which establishes the amounts and procedure for calculating state duties.

- The fundamentals of the legislation of the Russian Federation on notaries, regulating the activities of notaries and the limits of their competence.

- The Civil Procedure Code of Russia, which regulates the procedure for civil proceedings, in particular, the procedure for filing claims, grounds for refusing to consider a case, etc.

Cost of property division after divorce

Cases involving division of property are subject to the standard statute of limitations for civil proceedings – 3 years. In reality, this means that property can be divided many years after the divorce, because The countdown does not start from divorce.

It does not matter after what period of time it became necessary for one of the spouses to apply to a judicial authority with a claim for division. He will have to pay the standard government fee. And in most cases, the services of an expert will be required, because... After a long period of time, determining the value of the property yourself can be problematic.

The distance in time from the divorce does not affect the amount of the state duty and the cost of the appraiser’s services.