Before going to court to collect a debt, a claim is usually sent by receipt.

Very often, a separate loan agreement is not concluded between citizens, and the loans themselves are made “on trust”. But receiving at least a receipt when transferring funds in an amount over 10,000 rubles is mandatory, because only then is it possible to protect your rights, including in court by filing a statement of claim to collect the debt under the loan agreement.

Preparing a claim against a receipt yourself is not difficult and does not require special knowledge. Before drawing it up, we recommend that you familiarize yourself with the provisions of Chapter 42 of the Civil Code of the Russian Federation, which sets out in detail the procedure for early termination of a loan agreement, calculation of interest, etc.

:

Claim by receipt

Example of a claim on a receipt

Davletin Igor Alekseevich,

address: 630000, Novosibirsk,

st. Dobrolyubova, 194-38

from Veronika Sergeevna Akhmetova,

address: 633000, Berdsk,

Morskoy Ave., 64-87

Claim by receipt

On August 28, 2021, a loan agreement was concluded between us, under the terms of which I transferred funds in the amount of 75,000 rubles to your ownership. for a period until November 28, 2021, which is confirmed by the document issued in accordance with Art. 808 of the Civil Code of the Russian Federation with a receipt.

According to the terms of the receipt, funds must be returned in equal parts before the 28th of each month in the amount of 25,000 rubles. However, in violation of this agreement, the second payment in the amount of 25,000 rubles, which should have been made by you by October 28, 2016, was not received.

In accordance with Art. 811 of the Civil Code of the Russian Federation, if the loan is repaid in parts, if the deadline for repayment of the next part of the loan is violated, the lender has the right to demand early repayment of the entire remaining loan amount along with the interest due.

In accordance with Art. 395 of the Civil Code of the Russian Federation, for the use of someone else’s money, interest is payable, the amount of which is determined by the bank interest rate existing at the place of residence of the creditor (in this case, the lender) on the day of fulfillment of the monetary obligation. According to the information of the Central Bank of the Russian Federation on average bank interest rates on deposits of individuals for the purposes of applying Art. 395 of the Civil Code of the Russian Federation, in the Siberian Federal District the average rate is currently 8%.

Currently, guided by Art. 395, 808, 811 of the Civil Code of the Russian Federation, I demand early return of funds in the amount of 50,000 rubles. (principal debt), as well as pay interest for the use of other people’s funds for each day of delay, starting from October 28, 2016 until the date of repayment of the debt.

As of November 15, 2016, the period of delay is 19 days, therefore interest is payable:

25,000 rub. (debt)*19*8%/366 days = 103 rub.

I ask you to consider this claim within 5 days, otherwise I will be forced to go to court with a statement of claim to collect the debt, which will entail additional legal costs, which will be reimbursed at your expense.

11/15/2016 Akhmetova V.S.

How to file a claim against a receipt

There are different loan agreements - interest-bearing and interest-free, subject to repayment at the end of the agreement or in installments. Most often, a claim by receipt must be sent to:

- when the loan must be repaid in installments and the periodic payment has not been received: the contract can be terminated early and demand repayment of the entire loan amount;

- when the loan amount is not repaid in full or in part: then the claim contains a requirement to repay the debt and pay a penalty.

There is an opinion that if the contract does not stipulate interest for using the loan, then it does not need to be paid. But this is not entirely true: a loan between citizens is supposed to be interest-free for an amount of no more than 50 minimum wages, or when a certain thing is being dealt with. In all other cases, you can send a claim by receipt demanding payment of interest for using the loan.

Like any other claim, including a consumer claim, a document is drawn up in free form, but in writing, indicating:

- addressee of the claim;

- information about the person who sent the claim, incl. his address;

- name of the document (claim);

- when and between whom the loan agreement was concluded, which confirms this fact;

- calculation of the amount and the applicant’s requirements: return the loan, part of the loan, interest, pay a penalty, etc.

Rules for filing a claim

A demand for repayment of a debt against a receipt is made in simple written form. There are no statutory rules for this. However, if the lender draws up a document for the purpose of further presentation in court, it must include the following information:

- Name of the organization or full name of the individual who provided the loan.

- Address of permanent registration and actual residence of the lender.

- Full name of the defaulter (it should be indicated in the genitive case).

- Document's name. For example – “pre-trial claim”.

- The main essence of the problem that has arisen is with the indication of the date when the loan was granted, its amount and the time frame within which the debtor is obliged to repay the money. In addition, you must provide a description of the proposed payment schedule and information about how it was followed. If the agreement provides for the accrual of a penalty, then its amount must be indicated.

- You should declare your categorical disagreement with the actions of the borrower and demand that the entire specified amount be returned in a single payment and set a deadline for fulfilling this demand.

- Indicate the date of preparation of the document and the signature of the originator with a transcript.

Filing a claim by receipt

The prepared claim must be delivered to the addressee. At the same time, in order to confirm this fact. You can hand it over in person by asking for a signature with a transcript to be included in the second copy of the claim. In case of refusal to receive a claim, invite 2 witnesses who will certify the fact of refusal with their signatures.

You can also send your claim by registered mail with acknowledgment of delivery and a list of the contents.

What if the addressee does not respond to the complaint or does not take the required actions? Submit an application to the court for a court order or a statement of claim to collect the debt under the loan agreement.

If a claim is received based on a receipt, it makes sense to familiarize yourself with the statement of claim to recognize the contract as not concluded or to declare the transaction invalid.

Claims regarding receipts between individuals: sample for refund of funds

(last name, first name, patronymic in full)

on debt repayment by receipt

According to Part 2 of Article 808 of the Civil Code of the Russian Federation, in confirmation of the loan agreement and its terms, a receipt or other document may be provided certifying the transfer by the lender of a certain amount of money or a certain number of things.

Thus, "___"__________ ____ g.

A loan agreement was concluded between you and me.

Based on Article 810 of the Civil Code of the Russian Federation, the borrower is obliged to return the loan amount to the lender on time and in the manner prescribed by the loan agreement.

You did not return the loan amount to me on time.

The debt overdue period is currently _____ days, the bank rate is _____%.

I believe that, on the basis of Article 395 of the Civil Code of the Russian Federation, interest for the use of other people's funds is also subject to recovery.

I ask you to return me a sum of money in the amount of _________________________ rubles.

If this claim is refused, I will be forced to go to court to protect my violated rights, and in this case, in addition to this requirement, I will require additional compensation for legal costs.

"___"_________ ____ G.

If you do not have a legal education, experience in participating in litigation, if you are not sure that your tactics are correct, be sure to contact a lawyer or lawyer to draw up a statement of claim and to protect your interests in court!

From: Dmitry Alexandrovich Vladimirov

Address: St. Petersburg, Pavlovsk st.

Embankment no. 1, apt. 86

To: Korin Sergei Nikolaevich

Address:

Moscow, st. Sergeeva, 16, apt.

seven hundred eighty-one) ruble 00 kopecks.

on the return of funds under a loan agreement

On August 10, 2012, a loan agreement dated August 9, 2012 was concluded between me, Dmitry Aleksandrovich Vladimirov and Sergey Nikolaevich Korin.

The money was not returned within the period established by the contract. I have repeatedly reminded you of the deadline and suggested that you voluntarily repay the amount of debt, but to this day the funds have not been returned.

Vladimirov Dmitry Alexandrovich

For questions regarding the preparation of claims, statements of claim, contracts, additional agreements, and other documents, we recommend that you contact our lawyers by phone.

We invite you to read: Why is liquidation of an HOA needed and what is this procedure? Step-by-step instructions on how to properly close a partnership

- expiration of the payment period under the loan agreement (everything is just as simple here, this is proven by a receipt (the repayment period is usually indicated in it, and the letter of demand which I recommended above be sent to the debtor).

Based on the above, I demand that the loan be returned to me in the amount of _____ (in words) rubles within _____________. (we provide 30 days) “___”________ ___ g. __________________ How to send a letter to the debtor.

But there is a simple and effective way - we go to the post office and send this letter to the borrower’s address, always with acknowledgment of receipt.

The prepared claim must be delivered to the addressee. At the same time, in order to confirm this fact. You can hand it over in person by asking for a signature with a transcript to be included in the second copy of the claim. In case of refusal to receive a claim, invite 2 witnesses who will certify the fact of refusal with their signatures.

You can also send your claim by registered mail with acknowledgment of delivery and a list of the contents.

What if the addressee does not respond to the complaint or does not take the required actions? Submit an application to the court for a court order or a statement of claim to collect the debt under the loan agreement.

Clarifying questions on the topic

The bathtub renovation work was done poorly. The individual entrepreneur wrote a receipt that he would pay 54,000 in installments from July 11 to July 13. Currently, the amount has not been returned and is not answering calls.

Such a receipt will only serve as additional evidence in the case of consumer protection. You should file a claim in court against the work contractor to recover the amount.

Thus, it is up to the creditor to decide what to do in case of non-repayment of the debt: to act or to try on the role of a benefactor and forgive the debt. But if a citizen is going to return the money, he must first draw up a receipt when providing the money, which describes in detail all the conditions. Upon expiration of the debt repayment period, you need to file a claim indicating further actions. If this does not help, then you can safely go to court.

Most often, the parties neglect to draw up a separate loan agreement, drawing them up orally “on trust”. However, receiving funds in an amount exceeding 10,000 rubles requires at least a receipt.

This is explained by the fact that a loan of such size requires a document that can act as a tool to protect the rights of a citizen, including in court, if the plaintiff files an application for debt collection under the loan agreement.

Preparing a claim against a receipt is not a complicated procedure requiring special knowledge. However, before compiling it, we recommend that you study Art. 42 of the Civil Code of the Russian Federation, dedicated to the procedure for early termination of a loan agreement, accrual of interest, etc.

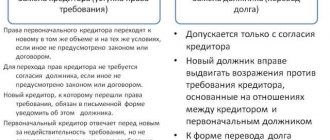

Loan agreements are divided into interest-bearing and non-interest-bearing, as well as those that are subject to repayment upon expiration of the agreement or those that are partially repaid.

Most often, a claim by receipt is sent in the following situations:

- In case of a partial return of funds, a periodic payment was missed. In such a situation, you can terminate the agreement early and demand the return of the entire loan amount in 1 payment;

- the loan amount was not repaid in full. The claim must indicate demands not only for repayment of the debt in full, but also for payment of a penalty.

There is a widespread belief that if the agreement does not indicate interest for using a loan, then there is no interest.

This opinion is only partly correct. An interest-free loan is for an amount not exceeding 50 minimum wages or if one thing is taken for temporary use.

In all other situations, a person has every right to file a claim against a receipt demanding payment of interest on the use of the loan.

Like other claims, the form of drawing up this document is absolutely free.

The following attributes are required in the claim:

- information about the addressee of the claim;

- information about the person who sent the claim (including his address);

- name of the document (in this case, “claim”);

- indication of the persons between whom the loan agreement was concluded;

- date of signing the contract;

- calculation of the amount and the applicant’s demands (for example, demands for the return of a loan or part thereof, payment of a penalty, etc.).

After preparing the claim, it must be submitted to the addressee. This must be done in such a way as to have confirmation of the fact of receipt of this document.

How to do it? You can hand it over and ask for a signature with a transcript on the duplicate claim. If the addressee refuses, invite two witnesses who will certify the refusal by putting their signatures.

Second option: send a registered letter with acknowledgment of delivery and a list of the contents.

In the event that the addressee refuses to respond to the claim or does not begin to implement the actions required of him, he should file an application for the issuance of a court order or a statement of claim to collect the debt under the loan agreement.

______________________________________ (last name, first name, patronymic of the debtor)

FROM ___________________________________ (last name, first name, patronymic in full)

CLAIM

I am “____”____________r. lent you _____________________ rubles. , and you, in turn, gave me a receipt indicating that you received a loan from me in the amount of _______ rubles. for a period up to “___”__________ ____, with payment _____% per month.

According to Part 2 of Article 808 of the Civil Code of the Russian Federation, in confirmation of the loan agreement and its terms, a receipt or other document may be provided certifying the transfer by the lender of a certain amount of money or a certain number of things.

Thus, “___”__________ ____ a loan agreement was concluded between you and me.

The debt overdue period is currently _____ days, the bank rate is _____%. I believe that, on the basis of Article 395 of the Civil Code of the Russian Federation, interest for the use of other people's funds is also subject to recovery.

7Moscow, Moscow region

7St. Petersburg, Leningrad region

8Federal number (free call for all regions of Russia)!

First of all, we call the debtor and negotiate with him regarding the timing of repayment of the debt on the receipt. Of course, everything depends on the situation, and it is possible that there is a chance to agree with the debtor that the debt will be paid in the near future.

In this case, it is extremely important not to leave everything at the level of oral agreements, but to record them in writing. You can issue a new receipt indicating a new deadline for repaying the debt.

Or simply prepare an Additional Agreement to the Receipt, which will indicate the new payment period.

If the debtor does not make contact, feeds you “breakfast” or simply does not pick up the phone, then it is quite reasonable to send him a written claim. Please note that the law does not provide for a mandatory claim procedure when collecting a debt on a receipt through the court. That is, it is not necessary to submit a claim.

However, we are still in favor of situations being resolved without litigation - if possible (since this will allow you to save a significant amount of money). Therefore, we still recommend sending a claim to the debtor in order to attempt a peaceful settlement of the dispute when collecting a debt on a receipt.

Based on our practice, a well-drafted claim leads to the fact that a significant part of debtors pay the debt on a receipt after receiving the claim. Or at least agrees in writing on installment payment.

- When drawing up a claim, it is necessary to refrain from any emotional assessment of what is happening, but simply state the existing facts - state the essence of the situation, the amount of debt, the period of its repayment, the period during which the debtor is obliged to return the money;

- Also, in a claim for collection of a debt on a receipt, it is necessary to warn the debtor that if the debt is not paid within the time frame established by the claim, you will go to court to demand forced collection of the debt on a receipt;

- It is imperative to focus on the fact that if you go to court to forcefully collect a debt on a receipt, this appeal will entail additional costs for the debtor - namely, the debtor will be required, in addition to the main amount of the debt, to also pay the amount of the state fee for consideration by the court statement of claim, as well as pay you the costs of hiring a lawyer who will prepare all documents and represent your interests in court hearings. Thus, the fact of going to court in order to collect a debt on a receipt will entail additional costs for your debtor, which is why it is more profitable for him to pay the debt immediately and not wait for the trial. As a rule, this argument very often influences debtors and, after receiving a claim, they begin to repay the debt;

- You should definitely indicate contact details and possible ways to repay the debt - for example, your bank account details or card number. Then, in the event of a legal dispute, the debtor will no longer be able to refer to the fact that he wanted to voluntarily fulfill the requirements, but was unable to do so due to the fault of the lender.

We invite you to read: What should a position sound like in the preamble of a contract?